Exchange-Traded Funds are one of the well-known investment tools/avenues for the investors and can maximise the gains provided they are utilised wisely. Ahead, we will discuss more on "wise investment of ETFs".

In simple words, investment in Exchange-Traded Funds give an opportunity to invest in a pool of financial securities. This pool is built as a single entity but holds different types of investments of various investors. Also, these shares are traded on the major Stock Exchanges and not Over-the-Counter.

Coming to its working, every investor in the ETFs gets a proportional stake with regard to its share in the pool of total securities. Moreover, there are some innovative ETFs related plans which let the investors short the markets. This helps them receive the benefit from the leverage without bearing short-term capital gains taxes.

Alright! As we have discussed what ETFs mean and how they work, let us move ahead and take a look at the contents of this article. This article covers:

- Origin and Types of ETFs

- Why Should You Opt for an ETF?

- ETFs in Times of Volatility

- What is VIX and how Does it Help?

- What to Consider While Building an All-ETF Portfolio?

Origin & Types of ETFs

ETFs originated in 1993 and the product they began with is popularly known as “Spiders” or “SPY” (ticker symbol). SPY is one such product that enjoyed recognition as being the ETF with the highest volume in history.

But, ETFs did not have a smooth start. There were a couple of attempts before the “true” or “actual” ETFs came into being. According to the author of “The Exchange-Traded Funds Manual”, the very first attempt at ETF was with the product known as Index Participation Shares which was mainly for S&P 500 in the year 1989. But, a Federal court in Chicago mentioned that the fund was not quite unique and had its working quite similar to futures contracts. Hence, it was mentioned that if they were to be traded, it was to be done on a futures exchange. This observation delayed the advent of “actual” ETFs.

Next was an attempt by the Toronto Stock Exchange in the year 1990 and the product was launched by the name Toronto 35 Index Participation Units (TIPs 35) which tracked the TSE-35 Index.

Finally after three years, on January 22nd in 1993, the State Street Global Investors launched the S&P500 Trust ETF known as the Spider or SPY as we mentioned above. This is still a well-known ETF and is continuing to maintain its popularity.

Ok! Let us move ahead to the types of ETFs and find out the different options you can invest in. We will quickly go through the most popular and common types of ETFs used by the investors to successfully profit from. And, the 7 types of ETFs are:

- Market ETFs

- Sector and Industry ETFs

- Dividend ETFs

- Style based ETFs

- Commodity ETFs

- Currency ETFs

- Bond ETFs

Exchange-Traded Funds have brought an evolution in the investing practices and have made it much simpler for investors to access a spread of several investment opportunities. Since there are so many ETFs in the market, it is quite a task to find the best one for yourself. Here, we will be discussing the most common and popular ones so that you are able to find the best fit for your portfolio with sheer ease. Let us take a look at each of the ETFs mentioned above.

Market ETFs

These are specially designed for tracking a particular index and, are the most common and well-known index. For instance, the SPDR S&P 500 tracks the S&P 500 or “SPY” of the U.S. stocks and is the best-known Market ETF. This type tracks the indexes which cover the entire or most of the stock market and also, covers a variety of the indexes. It is interesting to note that the cheapest ETFs are one of the least expensive investment avenues in the markets. Moreover, they provide you with a one-stop solution for the allocation of your assets.

Sector or Industry ETFs

These ETFs provide exposure to a particular industry or sector, like Pharmaceuticals, FMCG, and so on. The working of these ETFs includes breaking down the entire market into ten different sectors. This way, you tend to get a clear picture of the particular industry or sector which will be the most beneficial to you. While the Market ETFs provide you with the entire market coverage, the Sector or Industry ETFs get you the benefit of choosing a particular sector. This implies that when you choose a particular sector and it performs well, you get the entire profit without having to worry about a fall in profit because of some other sectors or stocks which may have performed poorly.

Dividend ETFs

These ETFs include those stocks which are dividend-paying so as to help investors with a substantial income. There are varieties of Dividend ETFs which are based on either maximizing current yield or income or on the basis of performance of dividend growth in the past. Both these types of Dividend ETFs have returns that vary a lot from each other. Since each type has a different strategy behind its application, it is important to include the one which best suits your portfolio. Also, your investment style plays a big role in determining which Dividend ETF will serve your purpose since the kind of investment you are familiar with, will be the one you may be more confident about.

Style Based ETFs

There are two well-known styles of investing in ETFs and the investors base their decisions on either the growth stocks or the stocks based on value investing. This is so because both the stocks are quite similar with regard to their performance. Investment in either of the stocks depends on the style of the investor. Based on their performance time-to-time, the investors decide the preference of one over the other. These ETFs are available for all kinds of stocks, of all sizes (large-cap, small-cap and midsized companies) domestically as well as internationally.

Commodity ETFs

These ETFs provide a great variety of options in the commodities market. This one is mainly for tracking the price of a commodity like gold, corn etc. The returns of these funds may or may not be synchronized with that of the stock market. This serves the purpose of those investors who look for a diversified portfolio (across asset classes). Maximum ETFs make use of derivatives like Futures, Forwards and others for getting exposure to the different markets. Whereas, some investors purchase the physical commodity with each stock displaying an amount of the same.

Currency ETFs

These ETFs benefit you by helping you earn profits out of movements in foreign currency values as compared with the U.S. dollar. There are two ways in which ETFs correspond to the currency values. One, by directly corresponding to the value of a certain amount of a particular currency. Secondly, by tracking the benchmarks of the currency moves like the U.S. dollar index.

These ETFs are helpful for hedging the investment or diversifying the same for certain things like, for vacation or to keep yourself safe from adverse price movements. The main importance of Currency ETFs is that they can be used as cash investments in terms of foreign currency. Also, because of this, they can be used as cash equivalents in Asset Allocation Strategy (that too with foreign currency exposure).

Bond ETFs

Basically, these ETFs offer great exposure to investors. There are two categories of Bond ETFs in which the Bonds available to the investors can be covered.

- Broad-Market Bond ETFs which cover the entire market.

- Bond Sector ETFs focus on particular bonds like Treasury Bonds, Corporate Debt and so on.

Mainly, the idea behind Bond ETFs is to provide investors with all types of bonds in the market. In this type, you should be aware of the focus of the fund which can be on maturity or it may roll over the maturing bonds and focus on buying the new ones. This depends on the requirement of your portfolio since the risks of interest rates vary for each type.

Great! With a good knowledge of the Origin and Types of ETFs, we can advance and discuss the reasons you should Opt for one of the ETFs. This will take us through the advantages of investing in ETFs and the top 5 Performances of the ETFs in the past with Python.

Why Should You Opt for an ETF?

If you know where all to utilise an ETF, you can succeed with the same. There are several reasons that make the investment in them quite beneficial, and one of them is that you do not require a lot of money for investing in the ETFs. This is because, in the pool of stocks, each share rarely goes beyond $100. It is usually $100 or lesser. With even this much investment, since the total amounts to a huge chunk of funds, your every share can get you interest in dozens or even hundreds from different companies. On the contrary, if there is very little money involved and you decide to invest in one or two stocks then there are chances of losing the entire money if the companies do not perform. Whereas in case these companies go on to perform really well, you will see a significant rise in your profits. This kind of rise or fall due to investment in few stocks is quite less likely to happen in case of a well-diversified portfolio. It is important to note that ETFs have the potential to provide profit steadily which investors find comfortable.

Secondly, there is an ease of access with ETFs. This simply implies that there are ETFs which take into account most of the investment assets there in the financial markets. Because of its wide coverage, ETFs allow you to invest in Stocks, Bonds, Commodities, Foreign Exchange, and also a mix of assets known as hybrid ETFs. As we can see, such a diversification helps with the ease of access to various asset classes. In general, there are these ETFs which provide you with the entire market in a single fund. Also, since the investment holdings are published on an every-day basis, there is a high level of transparency which puts the investor at ease even while building an all-ETF portfolio.

Thirdly, there are ETFs which offer subsectors of a particular asset class. This classification lets you invest in some companies as opposed to different companies belonging to different industries. As these ETFs dig down to offer you particular assets, you may benefit from investing in the stocks of the companies you expect to perform well. This can take place if you are aware about the trends (a particular scenario) that may favour a particular industry or some companies over rivals (other industries or some companies). For instance, Pharmaceuticals doing well in Coronavirus outbreak.

Fourthly, ETFs are cost-effective. This implies that the ETFs do not charge very high management fees. This is particularly because of the limited responsibilities of the fund manager. A fund manager keeping a check on ETFs requires to track the performance of a particular index (stock index or bond index) which the ETF chooses as its benchmark. This helps save the spending on those investment professionals who help you decide the particular investment options over others for outperforming the market. Comparing the fees of ETFs with similar options like Mutual Funds and Index Funds, you will always notice that ETFs are the most cost-effective or lowest-cost option available. Also, the tax benefits you get with ETFs is good since ETFs tax obligations are not impacted because of market fluctuations.

With investment in a particular ETF that suits your portfolio and investment style as well as preference the best, you can surely gain out of the same. With all the ways ETFs can help the investor profit, it seems like now we are packed with the necessary information.

A Key Takeaway:

ETFs are similar to Mutual Funds since they both are from the same concept of pooled fund investing. Pooled funds take all the securities together and offer investors the benefit of a diversified portfolio.

The difference between ETFs and Mutual Funds are:

- Fees related - ETFs are much more cost-effective than Mutual Funds

- Taxes - Mutual Funds levy more tax liabilities as compared to ETFs

- Management - ETFs are simpler to manage since they are more structured as compared to Mutual Funds

Let us get to know more about ETFs and their performance.

Last year had some great returns when it came to ETFs. You can see the table below to find out about the Best Performing ETFs of the year 2019 (excluding leveraged/inverse) with their Tickers and YTD return (%).

According to Yahoo Finance, Last year’s top 20 ETFs each saw gains of 50% or more. That’s not even including the leveraged products out there, like the Direxion Daily Semiconductor Bull 3X Shares (SOXL), the Direxion Daily Technology Bull 3X Shares (TECL) or the Direxion Daily Homebuilders & Supplies Bull 3X Shares (NAIL), up more than 185% a piece.

Source: Yahoo Finance

Also, there were top 4 best performing leveraged ETFs in 2019, which are:

Source: Yahoo Finance

Let us see how we can take out the data with Python for analysing the situation of stocks in the market.

To find out the performance in the year 2019, we can select any stock and fetch the data of the same for first month and last month. This way we can compare the performances of the stock in the beginning as well as in the end of the year. Let us take the ‘SOXL’ ticker and find out the performance of the stock in the first month (January) and the last month (December).

Running the above code will give us the following output:

To find out the last month’s data, we will run the code above and replace data.head() with data.tail().

And, the Output we get is:

Hence, data.tail() gives us the last five trading days’ data.

Comparing the data of both the months, we get to know how much SOXL’s performance jumped up by the end of the year 2019.

This way we can find the data for every ticker and analyse the market situation. As you can see, in both the Outputs, OHLCV for the start and end of the year 2019 are visible.

Now, we will use data.describe() to get the summary.

Running the above code will give you the following Output:

This way, we will get a general summary statistics so as to be sure about the intricacies of the data you are analysing.

Now, we will find the "daily returns" of four stocks by mentioning their tickers in the code below so as to compare the between the stocks. Please note that we can fill even more tickers of the stocks to find out the data for all with the same code.

Output:

Running the code above gives us the first five trading dates in the year 2019. This way, you can analyse the data of the companies you are interested in investing.

Great! Now, we will go ahead and discuss ETFs in Times of Volatility, which will cover the situations that arise in adverse events and the aspects that can be taken care of.

So, let us jump to another section now!

ETFs in Times of Volatility

As there is havoc created by Coronavirus Outbreak, let us pick an observation or real-world example to further see how ETFs help in Times of Volatility. It was observed in mid-March that HIgh-Yield witnessed its worst performance in quite some time, wherein its prices went down to 6% at one point. There was the scenario of dried up liquidity in the Bond markets, but few of the HIgh-Yield bonds were trading heroically and also traded for three to four times their average. This particular situation took place as the investors began investing in them in the hopes of securing themselves. Hence, ETFs were being used for Hedging, or for gaining exposure. Also, this makes us aware of the fact that ETFs help with enhanced liquidity.

This tells us how ETFs can be successful in the hardest times like in Pandemics such as ongoing Coronavirus Outbreak. They are also helpful in similar disastrous events which may bring expectations from investments down for many investors.

Here, as we just discussed, we can add in that ETFs can get you benefits like:

- Enhanced Liquidity

- Cost-effective Investment as compared to other similar avenues

- Support of Market Makers as ETFs help during the volatile market

ETFs have experienced situations as similar as this and have performed well in the same. Usually, on an average, around 25% of the volume is invested in ETFs, but recently, as Coronavirus Outbreak has changed the market scenario, they are averaging at about 40%. Also, in the first week of March 2020, in the U.S. market, ETFs were trading at $1.8 trillion while only $24 billion were in redemptions.

But, before trading in ETFs, you must take care of few points like:

- Avoid Market Orders because they are time-sensitive and will not give Market Makers any time to respond to the request of liquidity.

- Do not use Stop Loss Orders because, in the case of the markets hitting circuit breakers and pausing for 15 minutes, the stop loss order gets triggered. At the time of reopening, the order will be released while the liquidity providers are getting their bearings. In this scenario, there will be large gap-downs in the prices

- You should use Stop Limit Orders but be sure of picking the right limit so that you do not end up chasing the market for the price you set. Hence, you can take care of the price in the worst-case scenario.

Finally, we must accept that there is a lot of uncertainty, especially in scenarios where the market gets hit by a pandemic. One thing we are going to be certain about is that ETFs have time and again proved themselves to be durable, reliable and additive structures in the industry. ETFs are a must for any investor as they help you trade well even in dicey situations.

Now, let us move on to another helpful term known as VIX and how it helps in volatility.

What is VIX and how Does it Help?

VIX or the volatility index is basically a measure to find out the market volatility and hence, is also known as “fear-index”. It is usually used to track down the investor fear with regard to future volatile markets. Investors can trade the ETFs which track VIX so as to speculate the future market moves. This helps because with a speculated volatility in the markets, investors can hedge and insure their investments.

VIX is a ticker symbol and also is the well-known name for the Chicago Board Options Exchange (CBOE Volatility Index). It is a measure for the market’s speculated volatility on S&P 500 Index Options. Also known as “fear index or fear gauge”, VIX is calculated on a real-time basis by CBOE Volatility Index. The resulting VIX calculation provides the investors with a measure of expected volatility in the market in future. Based on this calculation, further stock market volatility can be predicted.

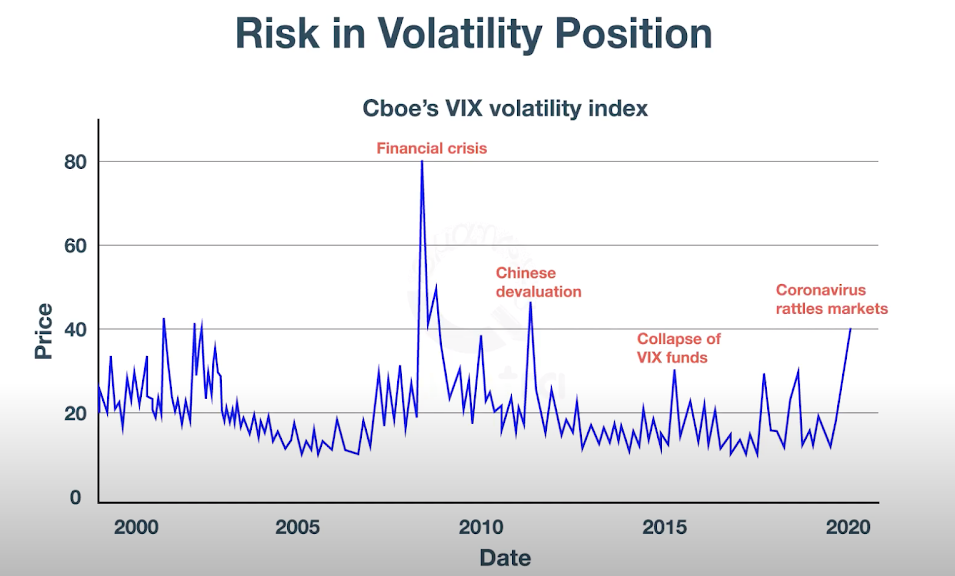

Let us take a look at the image below to understand the same better.

As you can see in the image above, VIX shows the volatility in the market on several occasions when the crisis struck the market. In 2008-09, on account of the Financial crisis, volatility took over and the sharp rise in the VIX index shows the same. Similarly, the volatility went high in 2012, when Chinese Devaluation happened, and in 2015, with the Collapse of VIX funds.

Now, in 2020, with Coronavirus Outbreak spreading, VIX indicates the huge jolt in the markets.

Now, let us find out more about VIX and get to the ETF side of it. VIX ETFs are one of the ways to access VIX index since you can not access it directly. VIX ETFs usually track VIX Futures Indexes. Within the VIX ETFs category, there are innumerable products, which can be traded.

A well-known example of VIX ETF is iPath S&P 500 VIX Short-Term Futures Exchange Traded Notes known as VXX. It usually trades higher in high volatility as compared to the low volatility times.

Source: Wikipedia

As you can see in the image above, when S&P 500’s shares fell in 2020 due to the pandemic, VIX index rose. This indicates a volatile market against which you can hedge your funds.

As we have seen what can be most helpful during the volatile times faced by the markets, we should know what Factors are to be Considered While Building an All-ETF Portfolio. If you are too impressed with ETFs and wish to build a portfolio which consists of only ETFs, then you must take a look at these useful tips ahead.

What to Consider While Building an All-ETF Portfolio?

In case you wish to build an all-ETF portfolio, the most important thing to consider here is that there should be a mix of various asset classes. These asset classes help create diversification and hence, will save you against the poor performance of one or more industries in a particular situation. Let us take a look at some instances of the asset classes we are mentioning here. These are:

- Commodity ETFs - These serve as an essential inclusion in the investor’s portfolio. As these include ETFs which can track everything from gold to corn to fabric, it is advisable to invest in a broad commodity ETF including various industries as mentioned above (in the same Commodity category). Investing in individual commodities may not be as beneficial since they may turn out to be volatile enough.

- Sector ETFs - These also offer diversification as they give you the opportunity to invest in different sectors, for instance, Medical services, IT, and so on. But, it is important to note that the investment must happen after checking the valuation of each sector, the economic outlook and certain other fundamentals.

- International ETFs - They help you cover all markets starting from domestic reach to international. Also, you can invest in markets that range from being emerging markets to developed markets. Again, you must be aware of the fundamentals like valuation, economic outlook etc. These ETFs track an index whether it has invested in a single Country or an entire Continent.

Going forward, there are some simple guidelines to take care of while building an all-ETF portfolio. These are:

Correct Allocation

Since it is extremely important to plan your investment in ETFs well, you must allocate your investments based on the following facts:

- Market Risk is significant and should be considered while getting an estimate of the stock’s return on investment. For instance, since equities carry more risk than bonds, it is beneficial to invest in equities, because equities may outperform bonds over a period of time. This is because of the market risk premium in the CAPM.

- On the basis of the same model CAPM, it is also observed that value stocks are inherently riskier, and thus, they outperform the growth stocks over a period of time.

- Also, Small-cap stocks tend to outperform the Large-cap stocks over a period of time since Small-cap stocks have more non-diversifiable risk attached to them.

The above observations make it clear that the investors who can take higher risks, should allocate a good amount of the portfolios in small-cap stocks or value-oriented stocks/equities. It is an extremely essential step since the allocation is responsible for almost 90% of the return.

Strategy Making

Another integral part of building an all-ETF portfolio is that you must make the right strategy since you have the options like selecting an ETF for a particular sector or a mix of sectors. Because of this wonderful option, it is much simpler to assess and analyse the available funds and select the ones which best meet the allocation targets set by you. Also, in this strategy, it is really essential to make sure that placing all the buy orders in a single day is not a wise decision. You must analyse and keep a close eye on the charts to be able to buy on dips. Also, you can put a Stop-Loss Order to reduce your potential losses. Ideally, Stop-Loss should not be more than 20%.

Assessing the Performance of the Portfolio

Checking the performance of your portfolio is extremely beneficial since it helps with the decision making of the trade. It should be done at least once a year. Some investors check the performance on the basis of their tax situations which makes the beginning as well as the end of the financial year the most ideal times for the same. This assessment also helps in:

- Balancing the ETF imbalances that may have occurred during some market fluctuations. A once-a quarter or once a year re balancing will be good to go.

- Deciding not to over trade when the trades are done within a limit.

- Change in your own situations. Assessing the portfolio helps you take care of your allocations with the change in your own situations.

This was all to consider while building an all-ETF portfolio. By keeping a check on all the mentioned points above, you should be able to build a successful portfolio for yourself.

This brings us to the end of the article and now, we will take a look at the Conclusion to go through what all we covered from the start.

Conclusion

Ok! As we have reached the end of the article, we must mention that we have put some light on the innovative nature of the ETF industry since the beginning. It has been observed that the ETFs have always been bringing better opportunities for investors and we believe that there will be many more new and unusual ETFs in the future. But, ETFs are to be used wisely as we mentioned the points to take care of while investing in them.

In this article, we went through the main aspects of succeeding with ETFs like types, advantages or why you should opt for them, the success in volatile times and also what all to keep in view while building an all-ETF portfolio. With all the information we hope you got a good overview of ETFs and how success is possible with them only if utilised wisely!

Discover more about how to trade systematically in the futures market by diving deeper with our Futures Trading course.

Disclaimer: All data and information provided in this article are for informational purposes only. QuantInsti® makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.