By Chainika Thakar and Rekhit Pachanekar

We discussed the basics of options trading in the previous blog. Here, in this blog, we will go a step further and discuss the strategies around options trading. There are a lot of options trading strategies that one can find but only a few hold the position of being called the ones that are the most popular among options traders.

Let us find this all with this blog that covers:

List of options trading strategies

Here is a list of options trading strategies below that you can learn about.

- Diagonal Spreads

- Calendar Spread

- Synthetic Long Put

- Long Combo

- Covered Call

- Bear Call Ladder

- Collar Options

- Straddle Options

- Jade Lizard

- Iron Butterfly

- Long Strangle

- Iron Condor

- Broken Butterfly

And there are many more out there that you can explore!

Did you know, leveraging the power of machine learning have incredible potential to enhance your trading strategy? Watch this video to witness how cutting-edge technology revolutionizes popular strategies. Elevate your trading skills to new heights with this game-changing opportunity!

Most popular options trading strategies

There are quite a few options trading strategies which can be used in today’s trading landscape (Check out the course on options trading strategies course by Quantra). The most popular options trading strategies are-

- Spreads and Butterflies

- Put-Call parity

Spreads and Butterflies

Spreads or rather spread trading is simultaneously buying and selling the same option class but with different expiration dates and strike prices. Spread options trading is used to limit the risk but on the other hand, it also limits the reward for the person who indulges in spread trading.

Thus, if we are only interested in buying and selling call options of security, we will call it a call spread, and if it is only put, then it will be called a put spread.

Depending on the changing factor, spreads can be categorised as

- Horizontal Spread - Different expiration date, same strike price

- Vertical Spread - Same expiration date, different strike price

- Diagonal Spread - Different expiration date, different strike price

Remember that an option’s value is based on the underlying security (in this case, stock price). Thus, we can also distinguish an option spread on whether we expect the price to go up (Bull spread) or go down (Bear spread).

Bull call spread

In a bull call spread, we buy more than one option to offset the potential loss if the trade does not go our way.

Let’s try to understand this with the help of an example.

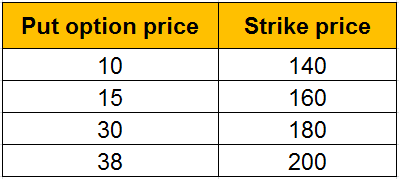

The following is a table of the available options at different strike prices for the same underlying stock and the same expiry date:

Normally if we have done the analysis and expect that the stock can rise to $200, one way would be to buy a call stock option with a strike price of $180 for a premium of $15. Thus, if we are right and the stock closes at $200 on expiry, we buy it at the strike price of $180 and pocket a profit of ($20 -$15) = $5 since we paid the premium of $15.

But, if we were not right and the stock price closes at $180 or less, we will not exercise the option resulting in a loss of the premium of $15. One workaround is to buy a call option with the price of $15 and the strike price of $180 and sell a call option for $200 at the call option price of $10.

Thus, when the stock’s price closes at $200 on expiry, we will exercise the call option we bought for a profit of $5 (as seen above). Also, we will pocket a profit from the premium of $10 we received from selling the call option since it will not be exercised by the owner. Thus, in this way, the total profit is ($5 + $10) = $15.

If the stock price goes above $200 and the put option is exercised by the owner, the increase in the profit from bought call option at $180 will be the same as the loss accumulated from the sold call option at $200 and thus, the profit would always be $15 no matter the increase in the stock price above $200 at the expiry date.

Let’s construct a table to understand the various scenarios.

You too can understand how to implement a bull call spread, implement it using Python, and check out the bull call spread payoff diagram.

Bear put spread

The bull call spread was executed when we expect the stock to increase, but what if we analyse and find the stock price would decrease? In that case, we use the bear put spread.

Let’s assume that we are looking at the different strike prices of puts of the same stock with the same expiry date.

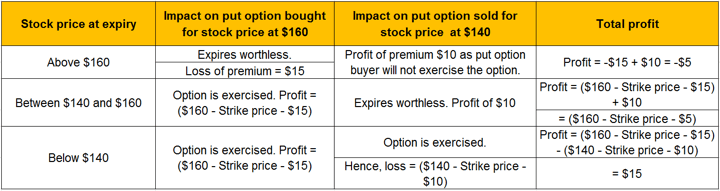

One way to go about it is to buy the put option for the strike price of 160 at a premium of $15 while selling a put option for the strike price of $140 for the strike price of $10.

Thus, we create a scenario table as follows:

In this way, we can minimise our losses by simultaneously buying and selling options.

Butterfly Spread

A butterfly spread is actually a combination of bull and bear spreads. One example of the butterfly options strategy consists of a Body (the middle double option position) and Wings (2 opposite end positions).

Considering that we have gone through the detailed scenario with regard to the Basics Of Options Trading, how about we combine a few options together?

Let’s understand an important concept that many professionals use in options trading. That is called Put-call parity. We will discuss this concept of put-call parity in Python.

Put-call parity

Put-call parity is a concept that anyone who is interested in options trading needs to understand. By gaining an understanding of put-call parity you can understand how the value of the call option, put option and the underlying are related to each other. This enables you to create other synthetic positions using various options and stock combinations.

The principle of put-call parity

Put-call parity principle defines the relationship between the price of a European put option and a European call option, both having the same underlying asset, strike price and expiration date. If there is a deviation from put-call parity, then it would result in an arbitrage opportunity. Traders would take advantage of this opportunity to make riskless profits till the time the put-call parity is established again.

The put-call parity principle can be used to validate an option pricing model. If the option prices as computed by the model violate the put-call parity rule, such a model can be considered to be incorrect.

Understanding put-call parity

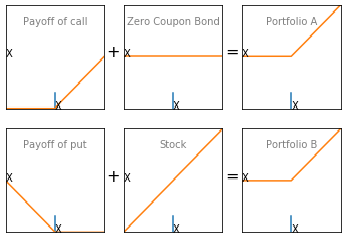

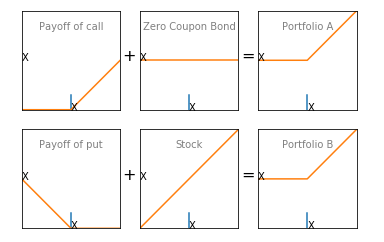

To understand put-call parity, consider a portfolio “A” consisting of a call option and zero coupon bond. The amount of zero coupon bond held equals the call strike price. Consider another portfolio “B” comprising a put option and the underlying asset.

S0 is the initial price of the underlying asset and ST is its price at expiration.

Let “r” be the risk-free rate and “T” be the time for expiration.

In time “T”, the Zero-coupon bond will be worth K (strike price) given the risk-free rate of “r”.

Portfolio A = Call option + Zero-coupon bond

Portfolio B = Put option + Underlying Asset

In the image above, if the share price is higher than X the call option will be exercised. Else, zero coupon bond will be retained. Hence, at “T”, portfolio A’s worth will be given by max(ST, X).

If the share price is lower than X, the put option will be exercised. Else, the underlying asset will be retained. Hence, at “T”, portfolio B’s worth will be given by max (ST, X).

If the two portfolios are equal at time, “T”, then they should be equal at any time. This gives us the put-call parity equation.

The equation for put-call parity:

C + Xe-rT = P + S0

In this equation,

- C is the premium on European Call Option

- P is the premium of the European Put Option

- S0 is the spot price of the underlying stock

- And, Xe-rT is the current value (discounted value) of Zero-coupon bond (X)

Required conditions for put-call parity

For put-call parity to hold, the following conditions should be met. However, in the real world, they hardly hold true and the put-call parity equation may need some modifications accordingly. For the purpose of this blog, we have assumed that these conditions are met.

- The underlying stock doesn’t pay any dividend during the life of the European options

- There are no transaction costs

- There are no taxes

- Shorting is allowed and there are no borrowing charges

Hence, put-call parity will hold in a frictionless market with the underlying stock paying no dividends.

Arbitrage Opportunity

In options trading, when the put-call parity principle gets violated, traders will try to take advantage of the arbitrage opportunity. An arbitrage trader will go long on the undervalued portfolio and short the overvalued portfolio to make a risk-free profit.

How to take advantage of arbitrage opportunities?

Let us now consider an example with some numbers to see how trade can take advantage of arbitrage opportunities. Let’s assume that the spot price of a stock is $31, the risk-free interest rate is 10% per annum, the premium on a three-month European call and put are $3 and $2.25 respectively and the exercise price is $30.

In this case, the value of portfolio A will be,

C+Xe-rT = 3+30e-0.1 * 3/12 = $32.26

The value of portfolio B will be,

P + S0 = 2.25 + 31 = $33.25

Portfolio B is overvalued and hence an arbitrageur can earn by going long on portfolio A and short on portfolio B. The following steps can be followed to earn arbitrage profits.

- Short the stock. This will generate a cash inflow of $31.

- Short the put option. This will generate a cash inflow of $2.25.

- Purchase the call option. This will generate a cash outflow of $3.

- Total cash inflow is -3 + 2.25 + 31 = $30.25.

- Invest $30.25 in a zero-coupon bond with 3 months maturity with a yield of 10% per annum.

- Return from the zero coupon bond after three months will be 30.25e 0.1 * 3/12 = $31.02.

If the stock price at maturity is above $30, the call option will be exercised and if the stock price is less than $30, the put option will be exercised. In both scenarios, the arbitrageur will buy one stock at $30. This stock will be used to hedge the short.

Total profit from the arbitrage = $31.02 - $30 = $1.02

Well, shouldn’t we look at some codes now?

Python codes for plotting the charts

The below code can be used to plot the payoffs of the portfolios.

Conclusion

Options trading strategies such as butterfly, spreads and put-call parity are the most widely and commonly used ones. With the application of an options trading strategy as per your requirement, you can trade options in the best possible manner.

If you want to learn more about options trading, you can enrol in our Systematic Options Trading course. This course will help you create, backtest, implement, live trade and analyse the performance of options strategy. Also, with this course, you will learn to shortlist options, and find the probability of profit, expected profit, and the payoff for any strategy. Moreover, with this course, you will learn to explore options trading strategies like a butterfly, iron condor, and spread strategies.

Note: The original post has been revamped on 20th March 2023 for accuracy, and recentness.

Disclaimer: All data and information provided in this article are for informational purposes only. QuantInsti® makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.