Guest Post by JB Marwood

There are many seasonal edges and market anomalies that exist in financial markets despite what the efficient market hypothesis might suggest.

Normally, the tricky part is finding those anomalies and being able to profit from them before they are discovered and arbitraged out.

The Tax Day Trade, which was investigated by Stephen Moffitt, is another such edge that appears to still exist to this day.

The Tax Day Strategy

The Tax Day Trade is a trading strategy that is based around the day in which federal income taxes are due in the US. It’s a one day trade whereby you enter the S&P 500 at the close on tax day and then sell it on the close one day later.

So this is a very simple trade to execute and one that relies on a simple behavioural bias.

Trade Results

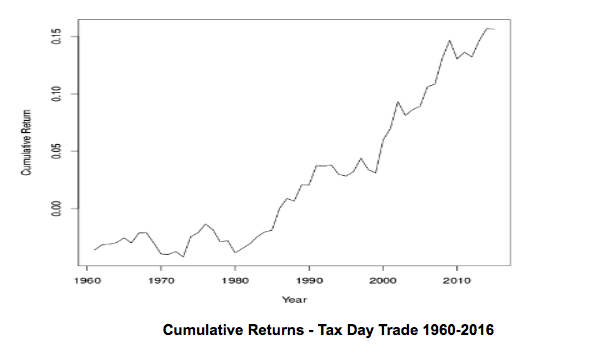

Since 1980 the Tax Day Trade has returned around 0.5% each year. You can see that returns since 1980 are pretty consistent:

Source: Moffitt, Steven, The Tax Day Trade: An Efficient Market Anomaly (February 2, 2017). Available at SSRN.

The most interesting part of the strategy is why there's an edge after 1980 and not before. Since 1980 the returns have been highly consistent. But before 1980, the results were far from attractive…

Why Is There An Edge?

To understand this, we have to look at the actual tax law and the changes that took place around that time to understand the basis for the edge.

There were two key developments around that time period that saw the tax and retirement landscape change in the US.

1974

- Employee Retirement Income Security Act of 1974 (ERISA) - Established IRA’s with restrictions.

1981

- Economic Recovery Tax Act of 1981 (Kemp-Roth Act) - Allowed all working taxpayers to create Individual Retirement Accounts (IRAs).

The Power Of The IRA

The law that was established in 1974 allowed some taxpayers to contribute to a tax-free individual retirement account (IRA) on or before the tax day deadline.

The changes in 1981 meant that IRA’s expanded to include all workers.

IRA’s are a powerful tool as they allow contributions that are free from tax.

As of 2017, you can either opt to pay no tax when you withdraw your money and pay tax on contributions. Or pay nothing on contributions and pay tax when you withdraw.

Such accounts are supremely popular with the general public since they allow a significant reduction in taxes that would normally be paid to capital gains.

Stock Market Anomaly

The edge in the market exists, therefore, because many people don’t want to pay their taxes until the last minute.

This could be for behavioural reasons (such as wanting to put off the unpleasurable task of filing taxes) or rational reasons (such as not having all the information required to properly file their taxes until the last day).

Either way, a great number of investors hold off until the last moment and then there is a rush to get their money invested into an IRA to save on taxes.

As a result, there is a consistent flow of money into US equity markets just when taxes are due to be lodged as taxpayers try to avoid paying taxes.

As shown by the analysis, buying S&P 500 futures on the close of the tax day and exiting on the close one day later has produced an average gain of 0.5% since 1980.

Conclusion

This strategy appears to be another seasonal edge that exists in financial markets that shows markets aren’t perfectly efficient.

Like all market anomalies, there is no guarantee that will it continue to work but it has been a consistent performer over the last 30 or so years.

This year (2018) tax day in the US falls on Tuesday 17th April.

Disclaimer: The views, opinions, and information provided within this guest post are those of the author alone and do not represent those of QuantInsti®. The accuracy, completeness, and validity of any statements made or the links shared within this article are not guaranteed. We accept no liability for any errors, omissions or representations. Any liability with regards to infringement of intellectual property rights remains with them.