For any trader in the financial markets, the time of crisis is a difficult one. Since there are different types of crisis such as natural disaster, man-made disaster etc., in each type a particular industry or a group of industries are affected more than others.

This was evident during COVID-19 as some industries such as hospitality, aviation etc. were affected badly. On the contrary, FMCG did great since the demand for consumer goods increased.

Let us find out more about trading in the time of crisis with this blog as it covers:

- What is a crisis?

- Types of crises that impact financial markets

- A timeline of crisis and their effect on trade in the past

- How to plan for a potential market crash?

- How do you get good returns from trading during a financial crisis?

- Which stocks thrive in a financial crisis?

- Why is gold known to be recession or crisis proof?

- What happens to commodity prices during a financial crisis?

What is a crisis?

Speaking from the global perspective, a crisis is how it sounds like - a serious situation that impacts a whole lot of people, segments, communities, industries etc.

Natural disasters such as earthquakes, tsunamis etc. can often lead to a crisis. However, there are also some examples in the past where man-made crisis such as the Great Recession hit the world economy seriously.

Types of crises that impact financial markets

Let us see the various types of crisis which are as follows:

Natural disasters

As the name suggests, they result from natural processes of the earth. For instance, during hurricane Katrina (2005) the stock market crashed.

Technological crisis

This is an event caused by malfunctioning of the technological structure and/or human error in handling or operating a technology/machine. For instance, one of the reasons for the Flash crash (2010) is believed to be the technological glitch in the reporting of prices on the U.S exchanges.

Rumours

These are the made-up or fake incidents made to go viral by an individual or a group across a community, country or globally. Such rumours can have an impact on the industries. For instance, in April 2013 there was a rumour about the then President of the United States, Mr Obama having had got injured by a White House explosion.

Man-made disasters

Man-made disasters such as terrorist attacks also impact the financial markets up to a great extent. For instance, the 9/11 terrorists’ suicide activity where terrorists crashed into the World Trade Centre in the U.S led to such an impact that the stock market was shut for a week.

A timeline of crisis and their effect on markets in the past

When any crisis takes place, markets fear the worst and stocks plummet accordingly.

But history is evident that after a while, optimism returns and prices do bounce back to where they were. Once the markets eventually start responding to fundamental factors rather than the perceived temporary turmoil, the effect of the crisis on the markets begins to fade. In hindsight, it often seems as though markets overreacted and fell too far, only to recover shortly thereafter.

Some of the well-known incidents that prove this point are as follows:

- Wall Street crash of 1929

- Friday the 13th 1989 (Mini crash)

- Black Monday 1987

- Early 1990s Recession

- Dot-com bubble 2000

- The financial crisis of 2007-08

- Flash crash in 2010

- COVID-19 crash 2020

How to plan for a potential market crash?

One way to make way for favourable returns in a crisis is to analyse if the volatile period is expected and plan for the same beforehand. An extremely reliable method to gauge if a crash is approaching is via the VIX volatility index.

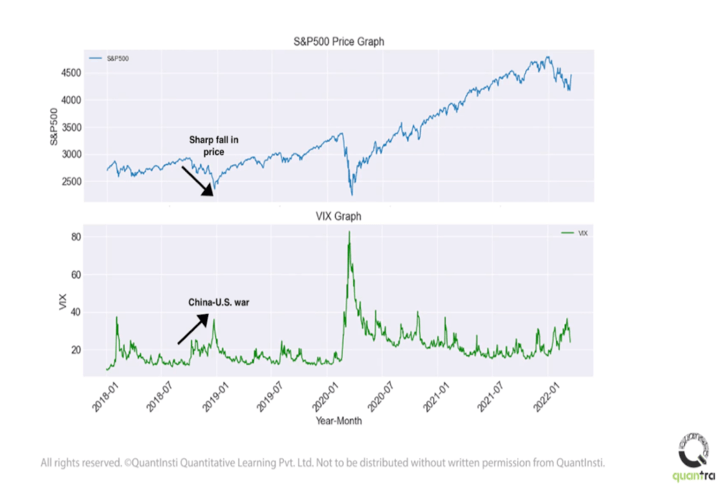

Let us see in the example below how the VIX has been an indicator of volatility in the past:

As you can see in the image above, the VIX graph showed a spike during the China-U.S. trade war scenario. Simultaneously, the S&P500 price graph showed a sharp fall in the price of its stock.

What to do if a market crash is approaching?

Financial markets are driven by factors such as sentiments based on news, tweets etc. When a market crash is expected, it can create fear and uncertainty for the traders. At this time, the news and social media updates can put a huge impact on the decision making regarding trading strategies.

Some commonly used strategies while preparing for a market crash are:

Short selling

Short selling stocks or shorting equity index futures is one good way to earn favourable returns in an expected bear market scenario. A short seller borrows shares that they don't already own in order to sell them, in hope of buying them back at a lower price later.

Options Strategies

Using options strategies is another way to plan for a bear market, such as buying puts as their value increases when the market falls, or selling call options that expire to zero price in case they expire out of money.

Bond and Commodity markets

Bond and commodity markets can also be utilised in the expected bear market scenario since the prices of both usually increase in a market crash.

Hedging

Hedging is an investment strategy designed to offset a potential loss. Hedging against market price risk means protecting yourself from the adverse movements in prices by attaining a price lock. This is done by using offsetting contracts against the natural position you hold while hedging against credit risk.

Hedging can be done using derivatives, as the relationship between derivatives and their corresponding underlying is clearly defined in most cases. Other financial instruments like insurance, futures contracts, swaps, options and many types of over-the-counter products are used to hedge.

Note: QuantInsti does not recommend following any particular strategies. The information is completely for educational purposes.

Many investors, however, are restricted from short selling or do not have access to derivatives markets. Even if they do, they may have an emotional or cognitive bias against selling short.

Furthermore, short-sellers may be forced to cover their positions for a loss if markets rise instead of fall and margin calls are issued. Also, there are shareholders of the Exchange Traded Funds that give long-short exposure to the market.

Impact of Rumours

It is important to note here that the biggest risk during a time of crisis or volatility scenario is that of a rumour. Rumoured news can make your investments head in the wrong direction and hence, losses can be inevitable.

For instance, in case the media portrays a false scenario, your trade will be misguided. This might lead to a market crash. It is extremely important to mitigate such fraud or risks by believing the news comes from only reliable sources.

How do you get good returns from trading during a financial crisis?

There are several steps one can take to minimize the impact of a financial crisis on your portfolio.

Portfolio diversification

One of the most important steps is to ensure you've diversified your portfolio (i.e., spreading your investments across multiple sectors, including stocks, bonds, cash, real estate, derivatives, precious metals, etc.).

You may also want to keep a small portion of your savings in safer investments i.e., Certificate of Deposit and Treasuries.

Timely analysis

It has been observed that each time, markets overreacted and fell too far they recovered shortly thereafter. For instance, as the impact of COVID-19 started to fade, the stocks (including industries such as hospitality, aviation etc.) began seeing a recovery.

As an investor, you should not consider panic selling in fear of losing your fortune. A timely analysis can help you take a wise decision that can save you from buying back your portfolio later at higher prices.

Value Investing

Similarly, value investing helps in such a scenario. The value investing strategy mainly focuses on investing in stocks that are trading at a much lesser price than their true value.

In short, value investing helps in reducing the risk because we only invest in value stocks during a time when their current price is much lower than the true value. This difference in true value and purchase price is also known as the “margin of safety”.

Recommended read: Portfolio & Risk Management

Which stocks thrive in a financial crisis?

No one knows the best stocks as such but some commodities like gold do better during a crisis. But, if you see the examples we discussed, every crisis has been different with regard to which stocks thrived in each scenario.

For instance, it was the FMCG sector that did well during COVID-19. Hence it is completely dependent upon the kind of financial crisis.

Let us see an example of Hindustan Unilever. Observe how the price of HINDUNILVR fell sharply during the COVID-19 scenario only initially. Following is the graph from March 2020 to April 2020:

The graph above shows how HINDUNILVR was initially affected by the COVID-19 crisis but later, picked up the pace with regard to stock prices.

Suggested watch: You should buy stocks during crisis

Note - The video above portrays the views of the owner of the content. QuantInsti doesn’t recommend trading any particular stock.

Why is Gold known to be recession or crisis-proof?

Gold is a commodity that has usually been considered recession proof. This is because:

- Gold is a commodity that can be moved from one country to another in case of crisis. Hence, the value of gold can be changed from one currency to another.

- It has been observed that during the recession, when stock markets crash, gold value usually goes up. Since the value of gold increases, it is indicative of gold having negative beta value which implies that gold value moves inversely as compared to equity indices.

What happens to commodity prices during a financial crisis?

The outcome with regard to the impact on the commodity prices is not fixed, but depending on the situation or the crisis type it differs. For example, in a war scenario where crude oil, and silver prices are going up, the oil price is increasing all across.

Let us find out the same with the help of an example in the Ukraine Russia war scenario. Following is the condition of the prices of three commodities namely Crude oil, Silver and Gold:

The image above shows the prices of the three commodities which are at an all-time high. In comparison, crude oil is at its peak whereas gold and silver are not trending at that high a price. Thus, it can be seen that commodity prices rose, but the crash occurred initially.

Let us see another timeline, i.e. COVID-19 outbreak. In this scenario also the prices first went down but gradually rose. In this timeline, silver was trending at a higher price as compared to gold and crude oil. Let us see what the graph looked like back then:

Conclusion

The time of crisis can be full of emotions such as fear for the traders. Such emotions can impact the trading strategies but, if a crisis is anticipated and planned well from the start, it can be much better.

In this blog, we discussed the crisis’ impact on the financial markets and also how to prepare well in advance for the same. The most important step of trading during a crisis is to always check with reliable sources to know the actual scenario of the financial markets.

If you wish to be well-prepared for a time of crisis, it is recommended that you too get started with algorithmic trading. This contemporary practice can keep you ahead as compared to manual practises for trading in the financial markets. You can utilise algorithms for keeping your decisions emotion-free during a crisis. Moreover, algorithms offer you quick and more reliable actions when compared to manual trading.

Disclaimer: All investments and trading in the stock market involve risk. Any decision to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. The trading strategies or related information mentioned in this article is for informational purposes only.