In recent years, we've witnessed an incredible transformation across industries, and quantitative finance is no exception. Thanks to the rise of AI, the game is changing, and it's changing fast!

AI is providing traditional quantitative roles with the newly introduced possibilities and is reshaping the way professionals work, analyse data, and make crucial decisions.

With AI, the complex tasks that can be automated are-

- Identifying different trading patterns and trends for various markets at the same time.

- Conducting market analysis to be able to adapt to the changing market conditions.

- Quants leveraging advanced tools to navigate the complexities of the financial landscape.

But, we must remember that incorporating AI into quantitative roles is not a walk in the park. It requires dedication, perseverance, and most importantly, a willingness to embrace change.

In this blog, we'll delve into the hurdles that quants face when integrating AI into their work as well as the benefits in order to weigh both. This way we will get to know how the pros are above cons while using AI for quant job roles and also the points of cons that need to be taken care of in the process.

We'll explore topics such as algorithmic trading, risk management, and the incredible potential that AI brings to the table.

So, whether you're a seasoned quant or someone who is simply fascinated by the intersection of finance and AI, this blog is your gateway to understanding the profound impact of AI on quantitative finance.

This blog covers:

- Is AI used in quantitative finance?

- Traditional and current approach of working as a quant

- How can quants use AI?

- Quant job responsibilities where AI can help

- Benefits of using AI by quants

- Challenges of using AI by quants

- AI and the future for quants jobs

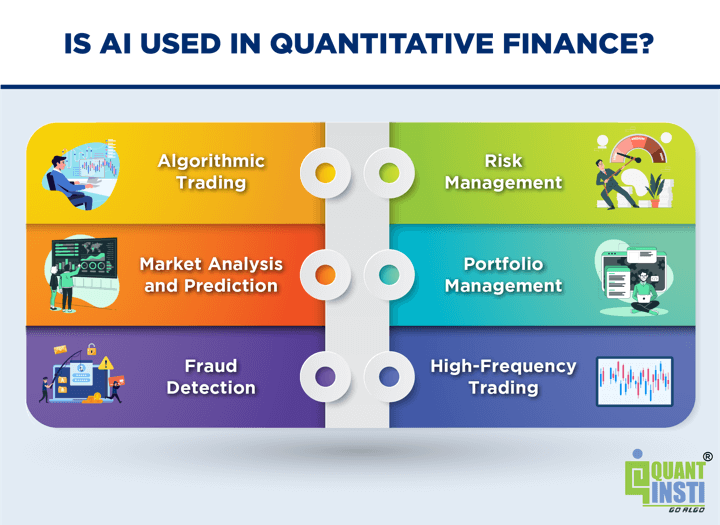

Is AI used in quantitative finance?

AI is widely employed in quantitative finance, a discipline that utilises mathematical and statistical models to analyse financial markets and make investment choices. AI techniques are utilised to enhance the precision and efficiency of these analyses.

In quantitative finance, AI is applied in several key areas which are discussed below:

Algorithmic Trading

AI algorithms automate trading strategies by analysing extensive financial data, detecting patterns, and executing trades rapidly. Machine learning techniques, such as neural networks and reinforcement learning, enable the development of trading models that learn from historical market data.

Risk Management

AI plays a crucial role in assessing and managing financial risks. Machine learning algorithms can analyse historical data to identify patterns and correlations, predicting future market movements and estimating risk exposures. AI models can also create advanced risk models, stress testing frameworks, and portfolio optimisation strategies.

Market Analysis and Prediction

AI techniques, including natural language processing (NLP) and sentiment analysis, are utilised to analyse news articles, social media feeds, and other textual data, providing insights into market sentiment and making predictions about market trends.

Portfolio Management

AI-based algorithms optimise and rebalance investment portfolios by considering factors such as risk tolerance, return objectives, and market conditions. Machine learning techniques in quantitative finance aid in identifying optimal asset allocation strategies and constructing diversified portfolios.

Fraud Detection

AI models can detect fraudulent activities in financial transactions by learning from historical data and recognising patterns associated with fraudulent behaviour. This helps mitigate financial risks associated with fraud.

High-Frequency Trading

AI techniques analyse real-time market data and make rapid trading decisions. Machine learning in quantitative finance helps to identify patterns in market data and execute trades quickly, capitalising on short-term price movements.

Let us move to quantitative analysts and discuss their traditional approach as well as the current approach of working as quants.

Traditional and current approach of working as a quant

Traditionally, quants worked manually but nowadays the approach of quants has become completely digital. Let us discuss in detail the working approach of a quant both traditionally and in the current scenario below.

Traditional Approach (How it used to be for quants?)

- In the past, quants typically followed a traditional approach that involved manually developing mathematical models and analysing financial data. They relied heavily on statistical techniques and mathematical formulas to make investment decisions.

- Data processing and analysis were time-consuming, often limited to historical data and predefined indicators. Quants spent a significant amount of time cleaning and organising data before conducting analyses.

Current Approach (How it is now for quants?)

- With technological advancements and the availability of vast amounts of data, the role of quants has evolved. Quants now have access to high-frequency data, news feeds, social media data, and other alternative data sources.

- They use programming languages like Python and R, along with libraries and frameworks, to automate data processing, conduct complex analyses, and develop sophisticated models.

- Machine learning and AI techniques have gained prominence, allowing quants to identify patterns, uncover insights, and make more informed investment decisions.

Now as we have seen how quants have evolved, let us find out how quants can utilise AI for quantitative trading.

How can quants use AI?

To effectively utilise AI in their job roles, quants need a combination of technical knowledge and domain expertise.

Here are some ways through which quants can utilise AI to its full potential:

Get AI driven insights

Quants need to be open and adaptive to new technologies and methodologies. By embracing change, quants can leverage AI's capabilities to enhance their work and stay competitive in the field.

Leveraging AI tools

Quants should master the necessary skills and knowledge to effectively leverage AI's potential. By understanding AI algorithms, techniques, and applications in quantitative analysis, quants can harness AI to improve decision-making, risk management, and strategy development.

Aiding in Experimentation and Innovation

Quants can be the pioneers in embracing and leveraging AI in their work. Hence, by embracing AI's potential, quants can not only adapt to the changing landscape but also thrive in their roles. Continuous learning, experimentation, and innovation can help quants to stay ahead in the field of quantitative finance.

Using AI to create trading strategies

Quants should adopt strategies that can maximise the impact of AI in their work. They should explore and utilise AI techniques to their full potential, incorporating them into their existing workflows and processes. By effectively integrating AI into their quantitative analysis, quants can enhance their decision-making capabilities and achieve better outcomes.

By combining the above mentioned areas, quants can effectively leverage AI in their job roles. They can develop sophisticated models, analyse complex datasets, and derive valuable insights to support decision-making, risk management, and trading strategies in the financial industry. Continuous learning and staying updated with the latest advancements in AI are also vital to harness its full potential.

There are several job responsibilities of quants where AI can be of huge help that we will discuss next.

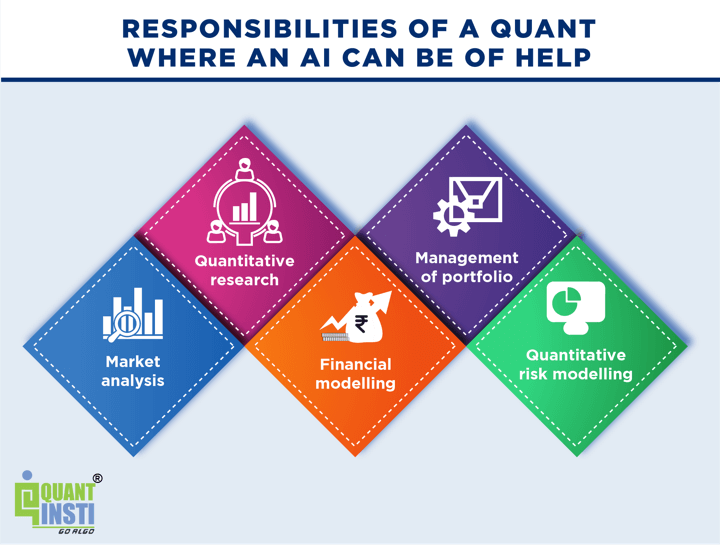

Quant job responsibilities where AI can help

AI plays a crucial role in analysing vast amounts of historical data, identifying patterns, and generating trading strategies.

By leveraging machine learning algorithms, AI can uncover hidden insights and relationships within the data that humans may not easily spot. Hence, AI can help quants in their job roles with the above mentioned capabilities.

A quant holds the following job titles -

- Quant Trader

- Data Scientist

- Quant analyst

- Quant Researcher/ Quant Strategist

- Quant Developers

- Quant Strategy Developers

Below are the different responsibilities of a quant where AI can be of help.

Quantitative research

One of the significant advantages of AI in quantitative research is its ability to automate backtesting. Traditionally, backtesting involves manually testing trading strategies against historical data to evaluate their performance. However, AI automates this process, saving time and effort while providing more accurate results. By rapidly backtesting numerous strategies, AI can identify the most successful approaches and optimise trading models for maximum effectiveness.

Management of portfolio

One of the job roles of a quant analyst is portfolio management. AI provides valuable support to portfolio managers. It offers data-driven insights, portfolio optimisation techniques, and risk analysis. With AI's assistance, portfolio managers can make informed decisions regarding asset allocation, implement effective rebalancing strategies, and closely monitor portfolio performance. (Learn AI for Portfolio Management in detail in the Quantra course).

Market analysis

Market analysis is another area where AI can be of great help. By analysing market data, news feeds, and social media sentiment, AI can extract valuable insights, identify emerging trends, and uncover potential investment opportunities. It automates market surveillance, enabling timely detection of anomalies and outliers.

Financial modelling

In financial modelling, AI plays a crucial role by automating data processing, feature selection, and model selection. This automation streamlines the construction of complex financial models, resulting in improved forecasting accuracy. AI-driven models assist in pricing models, credit risk modelling, and other financial analysis tasks.

Quantitative risk modelling

AI integrates machine learning algorithms, simulation techniques, and statistical analysis to develop advanced risk models. It supports modelling credit risk, market risk, operational risk, and other financial risks.

Benefits of using AI by quants

Quants can use AI for assistance in their jobs, this would bring numerous advantages to them.

Let us learn about all the benefits of using AI by quants below.

Enhanced efficiency

AI can process vast amounts of data and perform complex calculations much faster than humans. This leads to increased efficiency in tasks such as data analysis, model development, and risk assessment.

Data-driven insights

AI algorithms can uncover patterns, trends, and correlations in large datasets that may not be apparent to human analysts. This enables quants to gain deeper insights and make more informed decisions based on data-driven evidence.

Improved decision-making

AI can provide quants with valuable insights and recommendations, enabling more accurate and timely decision-making. It can help identify trading opportunities, optimise portfolios, and manage risks effectively.

Automation of routine tasks

AI can automate repetitive and time-consuming tasks, freeing up quants' time to focus on more strategic and value-added activities. This increases productivity and allows quants to allocate their skills and expertise to more critical areas.

Scalability and adaptability

AI systems can handle large and diverse datasets, making them highly scalable. They can adapt to changing market conditions and learn from new data, ensuring that trading strategies and models remain relevant and effective.

Challenges of using AI by quants

After seeing all the benefits, let us now come to its share of challenges that quants have to face. These are:

Over reliance on AI: While AI can provide valuable insights, relying solely on AI systems may lead to a loss of human judgement and intuition. It's important for quants to strike a balance between leveraging AI capabilities and using their domain expertise to make informed decisions.

Interpretability and explainability: Some AI models, particularly deep learning models, can be highly complex and difficult to interpret. Hence, one needs to gain thorough knowledge in the AI domain to overcome this.

Data quality and bias: AI heavily relies on data, and if the data used for training AI models are biassed or of poor quality, it can lead to biassed or inaccurate results. Ensuring data quality and addressing biases requires careful data selection, preprocessing, and ongoing monitoring.

Regulatory and ethical considerations: The use of AI in finance raises regulatory and ethical concerns. Compliance with regulatory frameworks, addressing issues of privacy and data security, and ensuring fairness and transparency in AI models are crucial considerations that quants must navigate.

Skill requirements and learning curve: Adopting AI technologies requires quants to develop new skills and expertise in areas such as machine learning, programming, and data analysis. There may be a learning curve associated with implementing and effectively utilising AI tools and techniques.

Nevertheless, the cons can be overcome if one follows the rules and regulations and holds the dedication and perseverance to learn. Moreover, if the quant combines the manual judgement with AI capabilities, the benefits are many.

AI and the future of quant jobs

In the coming years, Machine Learning, AI, and Data will play a pivotal role in shaping the industry. The availability of vast amounts of data and affordable computational resources has spurred the rapid progress and widespread adoption of machine learning and AI across various sectors, particularly finance.

It is widely acknowledged that bridging the skill gap necessitates not only access to these emerging technologies but also substantial up skilling of the workforce.

The combination of quantitative finance expertise (quants) and AI capabilities is expected to make the future better.

With AI in the future, you can analyse vast amounts of complex data, spot patterns that may have gone unnoticed, and generate predictive models that give you a deeper understanding of market dynamics. It's like having the support of an analytical brain that can crunch numbers and extract valuable insights in a fraction of the time.

Moreover, AI in the future can revolutionise risk management, a crucial aspect of quant work. By leveraging AI algorithms, you can assess risks in real-time, identify potential threats, and simulate scenarios to see how they might impact your portfolio. This empowers you to proactively manage risks and develop more effective hedging strategies.

Further, an AI-powered system can analyse massive amounts of market data, news feeds, and social media sentiment in real-time. This system can make lightning-fast trading decisions, optimising trade execution and identifying opportunities that may have gone unnoticed by human traders.

So, the future for quants using AI is full of exciting prospects.

Enhanced decision-making, advanced risk management, automated trading strategies, alternative data analysis, robust quantitative models - the possibilities are endless.

By embracing AI technologies and staying adaptable in this rapidly changing landscape, the quants can stay ahead of the curve and make a significant impact in the world of quantitative finance.

Bibliography

- How Recent Advancements in AI may Affect Quantitative Finance.

- Impact of AI on future job roles

- AI and stock market: Can we grow our wealth with quantitative strategies in India

Conclusion

Artificial intelligence is not meant to replace quant jobs or jobs in any field. Rather AI is there to assist and simplify the lives of those who can utilise the advancements in technology.

By leveraging AI capabilities, quants can make more data-driven decisions, improve efficiency, and manage risks effectively.

While there are clear benefits to using AI in quant job roles. Simultaneously, there are challenges to consider which can be overcome by enhanced learning and the willingness to utilise the capabilities of AI.

Looking ahead, machine learning, AI, and data will continue to be key drivers in the financial services industry. As technology advances, it is crucial to invest in up skilling the workforce to meet the growing demand for expertise in AI. By embracing these emerging technologies and fostering a human-AI partnership, we can harness their potential to enhance decision-making, drive innovation, and create new opportunities in the future of finance.

If you want to know more about quants jobs and have placement related queries, you can check out our "placement opportunities in financial market” section. Here, you will find which exciting job opportunities are open for quants.

Disclaimer: All data and information provided in this article are for informational purposes only. QuantInsti® makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.