Today we look at a popular offering on the menu of Blockchain and Cryptocurrencies - Ripple and it's cryptocurrency, XRP. It is one of the top ten cryptocurrencies, with a market cap of more than 28 billion USD.

Cryptocurrencies are a hot topic these days. They are disruptive and exciting. Over the last few blogs in the series, we explored blockchain technology. We took a closer look at two of the major cryptocurrencies, Bitcoin and Ethereum, that led to some significant changes in the world of cryptocurrencies.

In this blog, we will cover the following topics:

What is Ripple?

As we have learnt in our earlier blogs, cryptocurrencies like Bitcoin and Ethereum harnessed the power of blockchain technology. They brought a major breakthrough by using the internet to transfer value.

However, due to the longer time to process the transactions, they were not comparable to the traditional systems for financial transactions like SWIFT. Hence, the lack of mainstream acceptance of cryptocurrencies for transactions. This is where Ripple came in!

Initially, the international financial system was fragmented and patchy. The collage of numerous financial institutions working in a discordant environment led to an error-prone and delayed payment process.

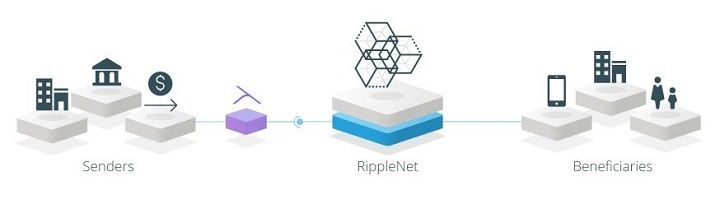

Ripple sought to improve the existing banking system instead of disrupting it. Ripple targets the banking and financial institutions to use the RippleNet to communicate and transact at low costs. RippleNet is an enterprise blockchain that uses the XRP Ledger and its native cryptocurrency XRP to provide faster payments worldwide.

So, as opposed to Bitcoin and Ethereum, which are public blockchains, RippleNet is a decentralized network of independent banks and payment providers that use a standardized protocol to send real-time, on-demand, low-cost and trackable payments across the world.

History of Ripple

Ripple was founded in 2012 by Jed McCaleb and Chris Larsen (co-founder of E-Loan). But the gears were in motion back in 2004, four years before Bitcoin, when a Canadian programmer, Ryan Fugger, developed RipplePay.

RipplePay, though not based on blockchain, was a secure payment system for a financial network. In 2012, Jed McCaleb and Chris Larsen started the company OpenCoin, renamed Ripple Labs in 2013.

Ripple approached the problem differently. It did not aim to replace the banking systems. Instead, its objective was to provide an alternative to conventional systems by providing a decentralized way to make quick payments with minimal transaction fees.

Ripple Labs created the Ripple transaction protocol (RTXP) in 2012 for fast money transfers across borders at low costs. The company created two main products for quick money transfer between banks - the xRapid and the xVia.

xRapid used XRP for value exchange, whereas xVia did not require it. Both these used to run on xCurrent. In 2019, the company combined xCurrent and xVia and rebranded them as RippleNet, whereas xRapid was renamed as ‘on-demand liquidity.’

What is XRP?

XRP is the native cryptocurrency designed for the Ripple network in January 2013. It was created primarily for transferring value between the participating parties instead of storing value.

The smallest unit of this cryptocurrency is one-millionth XRP or one drop.

XRPs are not mined - there is no proof-of-work or proof-of-stake here. In fact, all the XRPs, a total of 100 billion, were created at the beginning itself, and most of them are not in circulation. Around 60 billion XRPs are owned by the company itself, making some investors wary of investing in it.

To allay these fears, the company put 55 billion XRPs into cryptographically-secured escrow accounts in 2017. These were locked in 55 separate escrow accounts of 1 billion each that expire on the first day of each month starting at the end of 2017.

Once released, these XRPs become available to the company to fund business-related operations, sell to investors, and incentivize customers. Any unused XRPs will be put back in escrow.

Traditionally, standard banks, and other financial institutions use USD to convert one fiat currency into another, which causes delays in international transactions. Instead of USD, Ripple uses XRP for currency exchange.

So the exchange fee is not needed, thereby reducing the transaction costs significantly. Also, the transactions take just seconds to complete instead of hours or days.

XRP is used by banks to source liquidity instantly for money transfers, which leads to faster transactions processing.

While XRP was designed for the RippleNet, it can exist independently without the company. To clarify the common myths about Ripple and XRP, check out this article by Forbes.

Features of Ripple

RippleNet

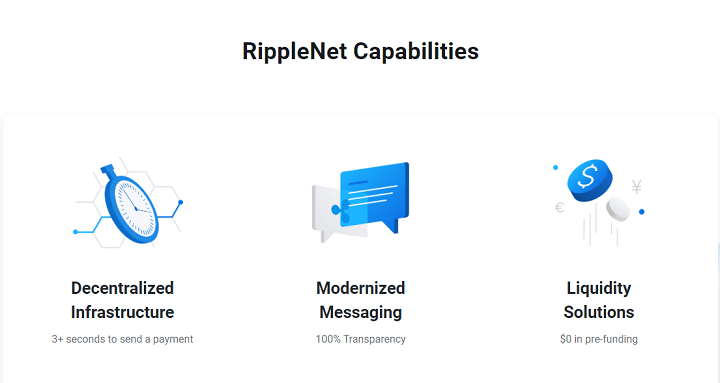

RippleNet is a network of payment facilitators that provides connectivity among the various financial institutions globally. It makes the transactions fast, efficient, and cheaper. RippleNet provides a decentralized structure, modernized two-way messaging, and liquidity solutions.

Say you want to transfer some amount from Japan to Nigeria. If we go about it the traditional way, the banks in Japan are not likely to have reserves of the Nigerian Naira (NGN). As you can imagine, there are various banks and payment providers involved in this setup, and each of them has its own set of rules.

RippleNet aims to provide a framework for the transfer of value across the internet by providing a set of rules called the Ripple Transaction Protocol (RTXP), which sets up common rules for all participants of the network to follow.

This eliminates the bottlenecks in the transaction processing and makes it easier for the network participants to work closely with each other. You can think of it as similar to the HTTP used as a common protocol for the transfer of information across the internet.

Consensus and Validation

Independent validator nodes come to an agreement about the order and validity of the XRP transactions by checking if they follow the RTXP. Ripple uses Ripple Protocol Consensus Algorithm (RPCA) to reach a consensus among the validator nodes.

Since the validators are already selected, and the total XRPs are already in existence, there is no mining process involved here. So no time, energy, or money is spent on mining.

The ledger reaches consensus on the outstanding transactions every 3-5 seconds, and the ledger is updated.

Anyone can be a validator by running the validator program. The validators are incentivized to maintain the ledger simply to benefit from using the system.

There are more than 150 validators on the network, with around 36 on the default Unique Node List - Ripple runs 6 of these nodes.

You can read more about the consensus protocol in this whitepaper.

Unique Node List

A unique node list (UNL) is a list of nodes that a participant of the network trusts. Anyone can become a validator by running the program. So, it is vital to add nodes to your UNL with caution.

Currently, three publishers (Ripple, the XRP Ledger Foundation, and Coil) publish the default lists of recommended validators based on their past performance, proven identities, and responsible IT policies. This is called a default unique node list (dUNL).

However, each network participant can select and add their own set of validators to the UNL.

Gateways

A person or entity who wants to join the Ripple network can approach the gateways. Gateways are usually run by banks. They provide an entry point to Ripple for people outside the network.

The gateway acts as an intermediary in the chain of trust between two parties who want to complete a transaction. The gateways help the customers to transfer funds, both traditional and cryptocurrency, using the Ripple network.

XRP Ledger

The distributed ledger for the XRP currency is a record of all the transactions done using XRP that are confirmed by the validators. It is called the XRP Ledger (XRPL).

XRPL is maintained by independent participants of the network and updated every few seconds. While Ripple is a contributor to the network, its rights are the same as those of other contributors. The payments are irreversible, and there are no chargebacks.

The XRP Ledger is designed to work with currencies other than XRP as well.

On-demand Liquidity

Traditionally, the USD is used as the reserve currency in global financial transactions. Let us revert to our previous example of transferring some amount from Japan to Nigeria.

If we go about it the traditional way, the banks in Japan are not likely to have reserves of the Nigerian Naira (NGN). But all the banks world over maintain reserves of the US dollar (USD).

So first, the Japanese Yen (JPY) has to be converted to USD, and then this USD will be converted to NGN in the destination country for the transfer to take place.

XRP is designed to serve as the bridge currency among the different payment providers on the Ripple network.

The accounts must be pre-funded to transfer money quickly from one currency to another. However, it is a risk for the bank to use its working capital for pre-funding.

XRP provides on-demand liquidity (ODL) through a trust line, which is similar to a limited line of credit. On-demand liquidity is a service provided for eligible institutional RippleNet customers only- not for retail customers.

How does Ripple work?

By design itself, Ripple works differently from the other blockchain-based cryptocurrencies like Bitcoin and Ether. This network is more centralized.

Here, anyone can become a ledger holder by downloading the required software. However, there are a small number of trusted validator systems that approve the transactions. These validators are usually owned by well-known banks and institutions, and trust is built primarily on their reputation.

Any transaction is approved only when the majority of the validators agree to it.

Every time a new transaction is made on the network, the validators validate it and update the ledger within seconds. The software ensures that the ledgers reconcile, and in case of a mismatch, the transaction is put on hold till the discrepancy is resolved.

The transactions are processed in a matter of seconds with low transaction fees. Currently, the network processes up to 155 transactions per second with an average fee of 0.0002 USD. Compare this to the Bitcoin network that takes approximately 10 minutes to confirm the transactions, and the fees can go up to 25 USD.

It is important to note that this entire process is transparent to the end-user. It appears to be just a simple matter of real-time transfer of money for the end-user.

On the RippleNet, the transactions can mainly occur through two media: through the XRP or IOUs. When a bank transfers an amount to another bank, they have two options: to pay XRP for currency conversions or to write an IOU.

If the transaction is settled via XRP, the transaction is completed and final because XRP is a tradable asset.

However, if the banks prefer to keep an open tab, they may issue an IOU. An IOU (I Owe yoU) is similar to a debt note. It is not something you own but rather something you owe.

Of course, for you to accept an IOU from someone, you need to be able to trust that they will be able to pay you back. This is where the trustlines come into play.

On RippleNet, a trustline is similar to a line of credit, which is like an agreement to trust someone up to a certain amount. IOUs are not interchangeable, but you can use the IOU for the exchange of almost any asset.

Unlike IOUs, there is no counterparty risk with XRP. So why would anyone want to use IOUs for transactions? This is because, like other cryptocurrencies, XRP is also volatile, and hence it is yet to gain universal acceptance. So some institutions prefer to stay away from XRP.

Advantages of Ripple

Ripple offers many advantages over traditional payment systems.

- Ripple makes worldwide payments fast, efficient, and transparent as compared to the traditional systems. XRP acts as a liquidity tool that makes the processing seamless.

- Ripple transactions are faster than other cryptocurrencies. Compared to Bitcoin and Ethereum that settle transactions in a few minutes, XRP transactions take 3-5 seconds.

- Ripple offers improved scalability. XRP consistently handles 1,500 transactions per second, 24x7, and can scale to handle the same throughput as Visa.

- Ripple’s cross-currency payment system has attracted many financial institutions and banks to join its network.

- The blockchain network sets a trustless environment for different members to work closely and efficiently.

- Ripple is designed to cater to big banking and financial institutions. Hence, its solutions are tailored to their needs, which has propelled its popularity among such companies.

- Many major financial institutions trust and are using Ripple. It makes it more trustworthy.

- No inflation is possible because all the XRP are already created.

Disadvantages of Ripple

Let us now look at the disadvantages of Ripple.

- Ripple is designed mainly to attract the bigger players in the financial market. Hence, for retail users, it is of limited use.

- RippleNet is not a completely decentralized network like a public blockchain.

- Most of the XRPs are held by the Ripple company itself. This implies that the company may have control over the workings of the network.

- There are concerns that if the company wants to let go of its stock of XRPs, it may cause an oversupply in the market, causing the prices to plummet. One of the co-founders, Jed McCaleb, who left Ripple in 2014, owned around 4.7 billion XRP. He has been selling off huge chunks of this in numerous instances, fuelling such fears further.

How is Ripple different from Bitcoin and Ethereum?

Ripple |

Bitcoin and Ethereum |

|

It focuses on the bigger financial institutions and payment providers |

It focuses on individuals and seeks to break away from the central financial institutions |

|

This network can be used to transfer any commodity or currency, not just XRP |

Transactions are made using the native cryptocurrency |

|

Caters to quick and cheaper global transactions |

Higher transactions costs and low speed of transactions |

|

Scalable |

Scalability remains a challenge |

|

Semi-permissioned blockchain |

Public Blockchain |

|

Less decentralized |

More decentralized |

|

XRPs are not mined, so only a finite quantity is in circulation |

They are mined, so the number of coins in circulation keeps increasing |

|

Uses RPCA (Ripple Protocol Consensus Algorithm) for consensus |

Use proof-of-work or proof-of-stake for consensus |

|

Negligible energy consumption |

Huge energy consumption |

|

Running a validator requires minimal computer resources |

Being a validator/miner requires a lot of monetary/computing resources |

Ripple in the news

Ripple continues to be in the news for its various brushes with the law.

The first legal issue happened way back in 2015 when the company was fined 700,000 USD for violation of the Bank Secrecy Act for selling XRP tokens without proper registration. After this, Ripple introduced Know Your Customer (KYC) for future XRP investors.

In Dec 2020, the US Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs CEO Brad Garlinghouse, and Co-founder Chris Larsen. The lawsuit claims that Ripple solely controls the infrastructure of the cryptocurrency, so XRP is a security that is subject to registration with the SEC.

It also alleges that Ripple heavily relies on its XRP sales to fund its operations. Ripple Labs has insisted that XRP is a cryptocurrency and not a security.

The lawsuit has affected the price and acceptance of XRP. It is definitely being watched with great interest by the entire crypto community.

Conclusion

In this blog, we covered the history of Ripple, we explored what Ripple and XRP are, the features and working of Ripple, its pros and cons, and also how it differs from the two major cryptocurrencies - Bitcoin and Ether. We also looked at the reason why Ripple has been in the news recently.

From blockchain to the three major cryptocurrencies (Bitcoin, Ether, and XRP) that redefined fintech, we have covered a lot of ground in this series of blogs.

I hope these blogs have helped you understand more about the technology behind them, the pros and cons of the major cryptocurrencies, and their similarities and differences.

If you too wish to dive into the world of Ripple and other cryptocurrencies, check out this intermediate level Course on Crypto Trading Strategies by Quantra. Here, you will understand Cryptocurrencies, risks involved, how to Crypto trade and create 3 different intraday trading strategies in Python - all in just 2.5 hours! Check it out now!

Disclaimer: Any information regarding cryptocurrency in this article is intended to convey general information only. This article does not provide investment, legal, tax, etc. advice. You should not treat any information in this article as a call to make any particular decision regarding cryptocurrency usage, legal matters, investments, taxes, cryptocurrency mining, exchange usage, wallet usage, etc. We strongly suggest seeking advice from your own financial, investment, tax, or legal adviser. Neither QuantInsti® nor the author of this article accept responsibility for any loss, damage, or inconvenience caused as a result of reliance on information published in, or linked to, from this article.