By Chainika Thakar and Rushda Ansari

Value investing is one of the most interesting investing methods in the trading domain that is based on more than the just price of stocks. A stock can be trading at a lower price but be of a much higher value at the same time. Such a stock that is available at a discount when compared to its true value is bound to be favourable for the traders.

Let us find out more about value investing with this blog that covers:

- What is value investing?

- Example of value investing

- Importance of value investing

- Formula of Benjamin Graham

- How to identify value investing opportunities?

- Traits of a value investor

- Value investing for beginners

- Value investing vs Growth investing

- Advantages of value investing

- Disadvantages of value investing

What is value investing?

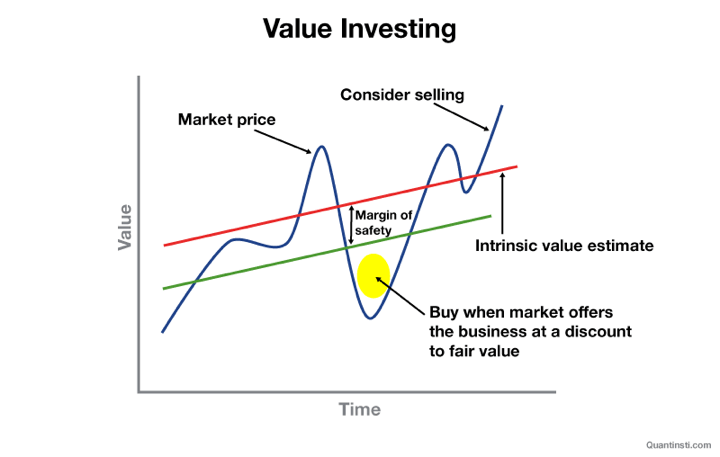

Value investing strategy mainly focuses on investing in stocks that are trading at a much lesser price than their true value.

In short, value investing helps in reducing the risk because we only invest in value stocks during a time when their current price is much lower than their true value.

This difference in true value and purchase price is also known as “margin of safety”. The concept of value investing was first introduced by Benjamin Graham who was also the mentor of Warren Buffet.

For Benjamin Graham, value investing meant finding companies that were undervalued and waiting until the market bid them up to their true value.

The value investor’s main motive is to find such companies that are underpriced. By investing in such undervalued stocks, there is already a safety margin since less price was paid.

The strategy here is to sell the stock either when the price of the stock reflects its true value or when it goes above its true value.

- Intrinsic value - The price level that reflects the actual worth or value of the company

- Margin of safety - The difference between purchase value and the true value

Example of value investing

Due to the pandemic in March 2020, financial markets globally witnessed a fall. Market participants were spooked and that resulted in a sharp sell-off.

But value investors saw an opportunity even during such volatile times. There were multiple opportunities in almost every sector. And these stocks were identified based on their valuation.

The companies that were undervalued and profitable caught the eye of value investors and got preferred positions in their portfolio. Also, the returns they earned a year later on these stocks were almost unbelievable!

Let's look at a few stocks and the returns they earned during 1 year:

|

Name |

Returns during March 2020 to March 2021 |

|

Moderna Inc |

343% |

|

Devon Energy Corp |

261% |

|

Marathon Oil Corporation |

215% |

But value investing is not all about buying the stocks that have fallen drastically due to the occurrence of a recent event. Take for instance the fall in the price of Meta stock (Facebook).

The Facebook Crash of Feb. 2022

On the 2nd of Feb 2022, the shares of Facebook crashed by nearly 26%. There were three reasons for this:

Users

First, the company reported a decline in the number of users for the first time since it was launched in 2004. The number of users is a key indicator of forecasting the future growth of this company.

Such instances where you may start to question the company’s future existence are a major red flag as per the theory of value investing.

The Metaverse

The second reason for dull earning’s report was an increase in expenses routed towards the “Meta-Verse” project. These expenses are only expected to increase in the near future, which implies that the earnings too are expected to remain subdued.

This was the cue to exit for traders who re-balanced their portfolios with a short term perspective. But value investors on the other hand, may try to delve deeper and may find this to be a good contribution to future growth prospects.

Apple

The third reason was Apple’s privacy update which compelled Facebook to take the user’s permission before tracking their activities. As we all know, a major proportion of Facebook’s income comes from running ads.

Ads are strategically placed after tracking the user's activities. The recent update from Apple directly impacts Facebook’s revenue. This again would pose a question on the company’s future growth in terms of earnings.

As a value investor, if you suspect that the value of Meta may increase in future due to certain projects like Metaverse, then you can buy this stock. However, if the true value according to you is lower than the current price, then don’t bother.

An important trait to be a successful value investor is to correctly estimate the true worth of the company and make use of opportunities where the market is significantly under pricing a particular stock.

Importance of value investing

Have you ever bought a stock simply because it was experiencing a bullish trend or because everyone else was buying it?

Well then, much like most retail investors, you too get influenced by market sentiments. For traders who have a short term perspective, being able to follow market trends is an important trait.

But for investors with a long term perspective, this might not be the right play. Value investing is the opposite of trading based on market sentiments. The concept of value investing is simple - buy quality stocks when they are available at a cheaper valuation.

Value investing is important to ensure that you’re getting your money’s worth. You can forecast future growth and performance up to a certain extent, but you don’t have any control over future events. Even if the company is expected to do well in the future, anything can happen!

For example, a pandemic could break out. Or developing countries can start hinting at cold wars. Or your own country can experience some border disturbances.

All of this impacts the economy as a whole, and these events are outside the scope of anybody’s control. The only thing that you can control is your entry and exit prices.

So wouldn’t you want to make sure that you’re doing it right?

You can’t be certain whether an investment is going to turn out to be good or bad, but you can definitely be certain about its true worth.

Have you ever seen a stock that witnesses buying/selling interest due to events unrelated to the business?

Investing in stocks based on the occurrence of unrelated events could lead to unfavourable consequences. Such stocks are extremely volatile and their movement is very difficult to predict.

But as a value investor, if you see a stock price fall significantly due to unrelated events, then this is an opportunity to buy.

Let's take Tesla's example. Shares of Tesla have been in the news for sudden price movements caused by mere tweets posted by the company’s founder, Elon Musk.

Here’s an instance:

Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock.

— Elon Musk (@elonmusk) November 6, 2021

Do you support this?

After this tweet was posted, Tesla shares witnessed a decline of nearly 16% during the next two trading sessions. Post the fall, if you think the true value is much more, then this is an opportunity to buy.

Formula of Benjamin Graham

If you’re not familiar with this personality, let us first introduce Benjamin Graham to you.

He was an American investor and economist. He was not only the mentor of one of the most successful investors - Warren Buffet but also the author of two bestselling books on investment: “Security Analysis” and “The Intelligent Investor”.

He created the strategy of value investing. In his book “Security Analysis” he also unveiled a formula to find the intrinsic/underlying value of a stock.

Benjamin Graham’s formula is mainly used for finding the best value investing opportunities. Here is the popular Graham’s formula we are discussing:

V = EPS(8.5+2g)

where,

V = Intrinsic value of a stock

EPS = Earnings per share

g = Expected growth rate of the company for the next 7 to 10 years

Twice the growth rate for the next 7-10 years is added to 8.5 which is the P/E (Price to Earning) base of a no-growth company.

Revised Formula of Benjamin Graham

However, in 1962, this formula was revised to make it more reliable and the updated formula is as follows:

V = EPS (8.5 + 2g) 4.4Y

where, 4.4 was the risk-free rate of return offered in the US during 1962.

Using Benjamin Graham's formula today

To adjust this as per today’s value, we divide it by the current yield on AAA-rated corporate bonds (Y). The reason for this is, the return rate or yield on AAA bonds is minimal as they are considered to be risk-free assets.

The formula proposed by graham might not be relevant in today’s world for a number of reasons. For example, the growth element here is quite subjective and may differ for each person based on their analysis.

In that case, another quick way to identify value stocks is through financial ratios. Important ratios to judge the value of a stock are: Discounted cash flow, Price to earnings (P/E) and Earnings per share (EPS). These ratios can be used as a secondary assurance rather than just depending on them solely.

Using Benjamin Graham's formula for Indian stocks

To use this formula for Indian stocks, you can simply replace 4.4 with the risk-free rate of return offered in India during 1962 and divide it by the prevailing rates offered on AAA-rated corporate bonds.

How to identify value investing opportunities?

Looking at the Graham formula, it’s easy to tell that the main elements of value investing are future growth potential and a set standard (risk-free rate of return) to compare with. Let’s dive deeper to understand how you can identify value investment opportunities by studying these elements.

Peer Comparison

The role of peers, in any industry, is to help you set a standard. Peer comparison helps you compare the value of one stock with another stock in the same industry and the same size. To determine peers, the revenue figure is used. For instance, companies with a revenue bracket of 4-5cr will all be peers.

Insider trading data

Note: By insider trading we mean the data pertaining to insider buying and selling of securities, which is a part of corporate filings. This data is especially available on the exchange for the interest of retail investors.

To understand future growth prospects insider trading plays an important role. When insiders buy more stake in the company, it shows their optimistic attitude towards the future growth of that company.

Certain parameters that you should check regarding insider trading are:

1. Only consider buying/selling of promoters and KMPs and their relatives (ignore other persons like employees, etc.)

2. If a promoter already has more than 20% stake before buying and is buying more stake, then it's a very good sign. Ignore stake purchase of shareholders with a holding of less than 10%.

3. The buy value should be substantial. To determine whether the size is substantial compare the buy value with the market cap.

4. Be sure that the purpose of insider purchase is not to nullify the institutional stock sales.

5. Recency effect - Purchases made more than 6 months ago should not be considered.

Process of checking insider trading (for Indian stocks):

- Go to the NSE website, click on the corporate information tab, on the left-hand side select “insider trading”. Select the timeframe and download the data.

- SAST regulation tab will show you all the buy/sell activities of institutional investors.

Capital Expenditure

If a company is taking up new projects, it means that they are expanding. Expenditure made to fund new projects for the purpose of growth and expansion is referred to as “Capital Expenditure” or “CapEx”.

Future CapEx details can also be found on the exchange’s website (NSE). A portion of this expenditure is funded by banks and some portion is funded by the company’s internal accruals. The internal accruals figure reflects the company’s confidence in the project.

So if you see a good amount going out of the company’s pocket towards a particular CapEx, it means that the company is expecting higher returns in terms of future growth in revenue.

Traits of a value investor

The traits of a value investor are best described as follows:

- Relies on numbers

- Risk mitigation

- Wealth generation

- Belief

- Market dynamics

Relies on numbers

You believe in relying on your valuation analysis and calculations instead of trend-based speculations

A value investor mainly looks to be on the safe side by making investments based on the valuation analysis and not mere speculations, which usually means taking a higher risk. Being a value investor requires a thorough understanding of market fundamentals and analysis techniques.

Risk mitigation

Mitigating risk is your forte when it comes to investing

As we discussed, relying more on the calculative risks and keeping risk management at the forefront is the forte of a value investor. The risk management practice keeps a value investor going strong in the trading domain.

Wealth generation

Your goal is to generate wealth in the long term

If long term investments are your focus, then value investing is for you since it may take some time for the stock's prices to match up to their intrinsic value. And hence, patience is the key with this style of investing. Waiting for a fair amount of time gives the market sufficient time to recognise the actual value of the stock.

Belief

Belief in your investment choices that is not based on short term price movements

Having a strong faith in your investment choices is an extremely important trait of a value investor. For most traders, the investment choices are usually based on the historical price analysis. But as a value investor, your investments are rather made on the basis of the actual value foreseen. You need to be confident about finding the company’s actual value.

For finding out the actual value, questions like these are of help:

- What does the company do?

- What is the advantage to its consumers?

- Who are its competitors?

- Why is the stock selling at a discounted price right now?

Market dynamics

You sought the knowledge of market dynamics

In the case of value investing, market dynamics play a highly important role. A value investor always respects the market conditions and makes investment decisions at the most favourable conditions.

Hence, when there are no viable opportunities, the investor must hold on to the funds and not make any investments.

Value investing for beginners

When you start investing, you either want to start small or start with something safe or both. When we talk about starting small, it means investing in small amounts.

And when we talk about safe investments, it means investing in companies that have a strong foundation. You start building your portfolio by investing in these companies which you can tell by looking at the fundamentals, are good for the long term.

Positional trades should form the foundation of your portfolio, after which you will be able to take the higher risks required to engage in short-term trades.

In simple terms, you need to be a profitable investor before venturing off as a trader. This is the safest play because, in the long run, you will have a cushion in the form of returns from value stocks to absorb the losses (if any) from your short term trades.

Value investing vs Growth investing

In the case of both, value stocks and growth stocks, the investment opportunities with favourable results are offered to the shareholders.

But, there is an interesting difference between the two that you can see here:

|

Value investing |

Growth investing |

|

The current market price trades at a discount, that is lower than the true value of the stock. |

The stock price may or may not be low, but the future growth potential of the company gives a buy signal irrespective of the price. |

|

The returns depend on the market volatility and the actual value of the organisation. |

The returns depend on the future growth potential of an organisation. |

|

Value investors evaluate future growth prospects based on the company's business model, its financial position, past performance, recent events and peer comparison. |

In the case of the growth investing, the investors evaluate a company's business model and solely focus on its future growth prospects. |

If you are an investor who likes low risk, then value investing is better because as a value investor you are more inclined towards being in the safety margin. However, if you are an investor who is confident about the growth potential of a particular organisation, you should invest in growth stocks.

Going forward, an even better approach would be to combine both the investing styles & aim at buying growth stocks when they seem to be undervalued. In this manner, the investment will be made on stocks with good growth potential and a discounted price.

Advantages of value investing

Advantages of this interesting investing technique, value investing, are as follows:

- Value investing holds potential for high rewards since the method itself revolves around investing in the stocks on the basis of the actual value of the company and not the trending price. The trending price may be less, for example, the stock price of Emirates in the COVID-19 scenario went down (due to government bound travelling restrictions) but the actual value was always high.

- If the valuation of the company is done correctly, the investment risk is lowered down to a great extent.

- Value investing is a wonderful opportunity for those who look for a long-term investment plan.

Disadvantages of value investing

The disadvantages of value investing are as follows:

- Since value investing is the type of investment that gets you returns in the future when share prices match the value, patience is the key.

- Valuation of the company’s actual worth can be tricky and requires expert knowledge of the markets and a good experience.

- One needs to hold in-depth knowledge and research for valuing the company’s worth for indulging in the value investing practice.

Conclusion

We discussed the meaning and relevance of value investing. With real-life examples, we discussed vividly how investing on the basis of worth or the value of the company returns favourable outcomes.

However, there are a set of particular traits of a value investor which make value investing more suited for them.

Do you want to construct your portfolio quantitatively, generate returns and manage risks effectively? Do you wish to learn different portfolio management techniques such as Factor Investing, Risk Parity and Kelly Portfolio, and Modern Portfolio Theory? The course on Quantitative Portfolio Management by Quantra is just what you need. Enroll now!

Disclaimer: All data and information provided in this article are for informational purposes only. QuantInsti® makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.