If you've ever been fascinated by the world of finance and dreamt of making informed investment decisions, you're in the right place. This blog is designed to introduce you to the exciting realm of live trading and provide valuable insights, software related tips, strategies to help you navigate the financial markets with confidence and the ways of going live.

We'll also explore how live trading differs from paper trading. You'll gain a clear understanding of the core of executing real-time trades as well as the prerequisites that are needed.

All the concepts covered in this blog are taken from this Quantra learning track on Technical Analysis Using Quantitative Methods. You can take a Free Preview of the course by clicking on the green-coloured Free Preview button on the right corner of the screen next to the FAQs tab and learn all these concepts in detail.

Let us discuss this all with this blog that covers:

- What is live trading?

- Live trading strategies

- Software for live trading

- Prerequisites for trading live

- How to do live trading?

- Paper trading vs live trading

- Go live with Blueshift

What is live trading?

Live trading involves actively buying and selling financial instruments in real-time markets to capitalise on price fluctuations. Traders execute trades based on current market conditions, aiming to generate profits. It requires monitoring market data, analysing charts, and making informed decisions.

Live trading requires the trader to equip oneself with the right knowledge, skills, and disciplined analysis for creating trading strategies with increased returns. While it offers profit opportunities, it requires proper preparation and effective risk management.

Live trading strategies

Live trading strategies are approaches and techniques employed by traders to make informed decisions and execute trades in real-time markets. These strategies aim to identify potential trading opportunities and manage risks effectively. Here are some commonly used live trading strategies:

Day trading

Day traders aim to profit from short-term price movements by entering and exiting trades within a single trading day. They often utilise technical analysis, such as chart patterns, indicators, and short-term trends, to make quick trading decisions.

Swing trading

Swing traders seek to capture medium-term price swings within a trend. They hold positions for a few days to weeks, taking advantage of price fluctuations during this period. Swing traders often combine technical analysis with fundamental analysis to identify potential entry and exit points.

Momentum trading

Momentum traders focus on stocks or other assets that are experiencing significant price movements and high trading volumes. They aim to ride the momentum of the trend, entering trades when prices are rising or falling sharply. Momentum traders often use technical indicators like moving averages and volume analysis to identify potential trading opportunities.

Here's an interesting video explaining how traders capitalize on existing trends using technical indicators like Moving Averages, MACD, and RSI Indicators.

Momentum Trading Strategies Course

Additional 75% off

Breakout trading

Breakout traders look for significant price breakouts above resistance levels or below support levels. They enter trades when prices move outside of a defined trading range, anticipating further price acceleration in the breakout direction. Breakout traders often use technical indicators like Bollinger Bands or support/resistance levels to identify potential breakouts.

Scalping

Scalpers engage in multiple trades throughout the day, aiming to profit from small price movements. They capitalise on short-term volatility and liquidity by quickly entering and exiting trades, often within seconds or minutes. Scalpers rely on fast execution and tight spreads to generate small but frequent profits.

It is extremely important to note here that each strategy carries risks and requires a solid understanding of its principles. It's important to customise strategies to fit individual trading styles and practise them in simulated environments before applying them to live trading with real funds.

Here's an interesting video on to understand what is scalping trading strategy and how scalpers leverage small price movements for quick gains.

Software for live trading

There are several software options available for automated trading platform. The features and functionalities in a software assist traders in executing trades and managing their portfolios. Optimize your strategies on a reliable Algorithmic Trading Platform.

Features of a good trading software

Let us see all the features that a trading software must have for a smooth trading experience. These features are:

Market data and charting

The software must provide comprehensive real time market data. These features offer real-time price quotes, historical data, technical indicators, and drawing facility to perform in-depth technical analysis.

Risk management

Risk management feature helps traders track and analyse their trading performance, manage risk, and maintain a trading journal. Such a feature assists in evaluating trade outcomes, identifying strengths and weaknesses, and improving overall risk management practices.

Backtesting

The feature of backtesting the trading strategies helps the traders to assess their strategy’s performance on the basis of historical market data. Once you are able to see the performance of the strategy, you can analyse patterns and make better decisions. If the trading strategy looks like it needs improvements (after backtesting), you can make amendments in the same.

Pre-built trading algorithms

With trading software, having a library of trading algorithms is a boon. You can customise the algorithms to suit your specific needs by setting the parameters and go live!

User-friendly interface

A user-friendly interface allows you to navigate through different features, place trades, and access essential tools effortlessly. It provides clear and organised displays of market data, charts, and order placement options. With a user-friendly interface, you can focus more on analysing the markets and executing trades rather than struggling with complicated software.

Comprehensive documentation

Comprehensive documentation provides clear explanations of the software's functionalities, setup process, troubleshooting tips, and frequently asked questions. With comprehensive documentation, users can maximise the benefits of the software, resolve issues independently, and make the most out of their trading experience.

Support from the software provider

Having reliable support from the software provider is like having a helping hand whenever you encounter issues or have questions. It means having access to a dedicated support team that can assist you in resolving technical difficulties, answering inquiries, and providing guidance.

It's important for traders to research and evaluate different features of the software before choosing any one.

Blueshift by Quantra is one such software with all the necessary features for live trading.

To get familiar with the Live Trading Integration feature of Quantra, check this video that explains the same.

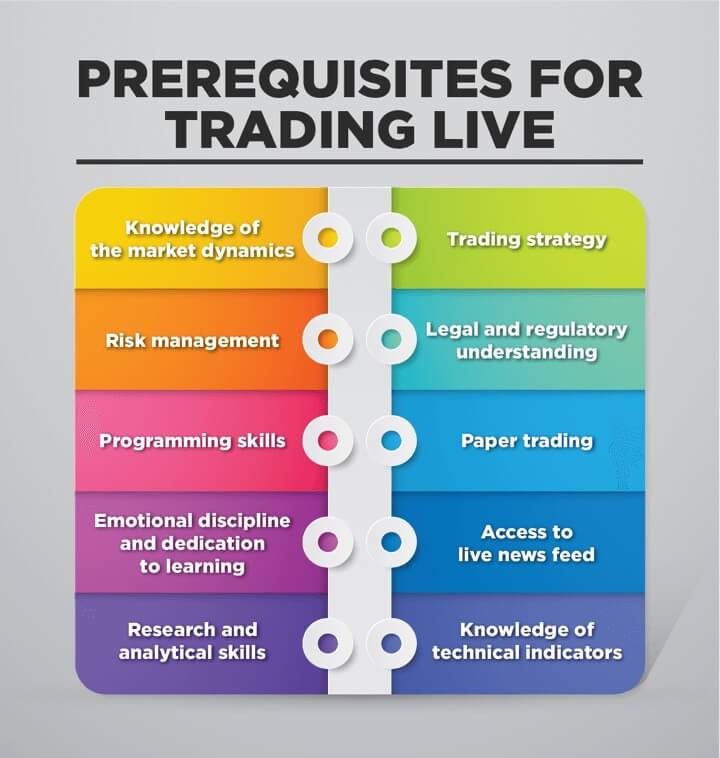

Prerequisites for trading live

Now, let us find out the prerequisites for going live. These will help you be ready for a successful live trading journey. These are:

Knowledge of the market dynamics

Having a good understanding of market dynamics is crucial for live trading. It means being aware of the factors that influence market movements, such as supply and demand, economic indicators, news events, and investor sentiment. It's like knowing the "pulse" of the market.

By keeping an eye on economic data, trends, and market sentiment, you can make more informed trading decisions. It's important to stay updated with financial news, monitor charts, and follow economic calendars to grasp the current market dynamics. This knowledge helps you identify potential opportunities and navigate the markets more effectively during live trading.

Risk management

Knowing how to do risk management is crucial for successful live trading. It's like having a safety net to protect your trading capital. Risk management involves strategies to minimise potential losses and preserve your funds.

It means setting stop-loss orders to limit losses if a trade goes against you, using position sizing to control the amount of capital at risk, and diversifying your portfolio to spread out risk.

By practising proper risk management, you can protect yourself from excessive losses and ensure long-term sustainability in your trading endeavours. It's like having an insurance policy for your trades. Remember, the goal is not just making profits but also managing risks effectively.

Programming skills

Having programming skills can be beneficial for live trading. It's like having a toolbox that empowers you to automate tasks, develop custom indicators, and implement algorithmic trading strategies.

With programming knowledge, you can utilise trading platforms that support scripting languages like Python to create your own trading algorithms. It opens up a world of possibilities for backtesting strategies, analysing data, and executing trades with precision.

Even basic coding skills can give you an edge in the dynamic world of live trading. So, consider learning programming to enhance your trading capabilities and explore new opportunities in the market.

Emotional discipline and dedication to learning

Emotional discipline and a thirst for learning are crucial in live trading. It's like having a mental shield and a growth mindset. Emotions can often cloud judgement and lead to impulsive decisions.

By practising emotional discipline, you can stick to your trading plan and avoid making rash moves based on fear or greed. Additionally, being dedicated to learning means constantly seeking knowledge, refining your skills, and adapting to market changes. It's like being a lifelong student of the markets. The two together will help you achieve long term success.

Research and analytical skills

Having strong research and analytical skills is like having a compass in live trading. It's about being able to gather and analyse information to make informed decisions. Research skills enable you to stay updated with market news, economic data, and company reports.

Analytical skills help you interpret this information, identify trends, and spot potential trading opportunities. By honing these skills, you can uncover valuable insights and make more accurate predictions about market movements. So, embrace research and analytical skills as your trusted allies in navigating the complex world of live trading.

Trading strategy

A trading strategy is a well-defined plan that outlines how you'll approach the markets and make trading decisions. Your strategy could be based on technical analysis, fundamental analysis, or a combination of both.

It helps you determine when to enter and exit trades, manage risk, and maximise profits. A solid trading strategy provides structure and discipline, guiding your actions and reducing emotional decision-making. So, invest time in developing a reliable trading strategy that aligns with your goals and trading style.

Legal and regulatory understanding

Having a solid understanding of the legal and regulatory aspects of trading is like knowing the rules of the game. It's important to be aware of the laws and regulations that govern the financial markets in your jurisdiction. This includes understanding requirements for opening a trading account, complying with reporting obligations, and adhering to anti-money laundering and know-your-customer guidelines.

By having a grasp of the legal and regulatory framework, you can trade with confidence, ensure compliance, and protect yourself from any potential legal issues. So, take the time to familiarise yourself with the rules and regulations relevant to your trading activities. It's like having a sturdy foundation for a successful and compliant trading journey.

Paper trading

Paper trading is like practising without risking real money in the live trading arena. It's a simulation of the actual trading experience. Instead of using real funds, you use virtual money to place trades and test your strategies. Paper trading allows you to gain valuable experience, fine-tune your approach, and evaluate the effectiveness of your trading plan.

It's a safe environment to make mistakes and learn from them without financial consequences. Treat it as a training ground to sharpen your skills before diving into live trading. So, consider paper trading as your rehearsal stage where you can build confidence and refine your strategies before taking the plunge with real money.

Access to live news feed

Having access to a live news feed keeps you updated with the real-time information about market-moving events, economic data releases, and breaking news. By staying updated with real-time news, you can make informed trading decisions and quickly react to market developments.

Whether it's financial news websites, news aggregators, or trading platforms with news integration, having a reliable live news feed is essential for staying ahead of the curve. So, make sure you have this valuable tool in your trading arsenal to capitalise on timely information and seize opportunities as they arise.

Knowledge of technical indicators

Having knowledge of technical indicators is like having a set of tools to decode the language of the markets. Technical indicators are mathematical calculations applied to price data, such as moving averages, MACD, or RSI. They help identify trends, potential entry and exit points, and gauge market momentum.

By understanding these indicators, you can interpret price charts more effectively and make informed trading decisions. It's like having a compass that guides you through the complexities of market analysis. So, invest time in learning about different technical indicators and how to apply them. It will enhance your ability to spot trading opportunities and navigate the dynamic world of live trading.

How to do live trading?

Going forward, let us find out how to do live trading with these steps:

Select a trading style

Choose a trading style that suits your personality, time availability, and risk tolerance. Options include day trading, swing trading, scalping, or position trading, each with its own characteristics.

Open a trading account

Choose a reputable broker with a user-friendly trading platform. Open a trading account by providing necessary documents and funding it with the desired amount of capital.

Develop a trading plan

Create a well-defined trading plan that outlines your goals, risk tolerance, preferred markets, entry and exit strategies, and risk management rules. A trading plan helps maintain consistency and discipline.

Get the simulated trading platform or start paper trading

Utilise a paper trading account or simulated platform to practise your strategies without using real money. This allows you to gain experience, test approaches, and evaluate the effectiveness of your plan.

Conduct market analysis

Use fundamental and technical analysis techniques to identify potential trading opportunities. Analyse economic indicators, news events, market trends, and price patterns to make informed decisions.

Execute trades and go live

When you identify a trading opportunity that fits your strategy, execute the trade through your chosen platform. By now you should have enough confidence to do live trading with real money. Enter the appropriate order type and quantity based on your analysis and paper trading experience.

Monitor and manage trade

Keep a close eye on your trades, monitor market conditions, and make adjustments as necessary. Implement risk management strategies such as stop-loss and take-profit levels to protect your capital.

You can check this video out to learn about doing live trading on the cloud.

Paper trading vs live trading

You can see below some vivid distinguishing features of each, paper trading and live trading.

|

Features |

Paper trading |

Live trading |

Risk |

In paper trading, you simulate trades using virtual or simulated funds. There is no real financial risk involved since you are not trading with real money. |

In live trading, you use real money to enter the market, which carries actual financial risk. Profits and losses are tangible. Hence, you need risk management tools in place for trading live. |

Emotional Factors |

Since there is no real money at stake, emotions like fear and greed may not have any impact on investments. It allows traders to practise their strategies and also their emotions for live trading. |

Emotions play a significant role in live trading. Fear and greed can influence decision-making, potentially leading to impulsive actions. Managing emotions and maintaining discipline is essential for successful live trading. |

Market Realism |

Paper trading attempts to simulate real market conditions. It can give you a glimpse of the nuances and psychological aspects of live trading. |

Live trading exposes you to real market conditions, including live price movements, order execution delays, and market volatility. It provides a more realistic trading experience. |

Learning and Skill Development |

Paper trading is an excellent learning tool for beginners and experienced traders alike. It allows you to practise and refine trading strategies, test new ideas, and gain familiarity with trading platforms and tools. |

Live trading provides an opportunity to apply the knowledge and skills acquired from paper trading in a real-time trading environment. It helps traders understand the practical implications of their strategies and builds experience in managing real-money trades. |

Go live with Blueshift

Live trade basically means you connect your trading strategy to the broker. So whenever you get a signal, in this instance, let’s assume it is ‘buy’, an automated order is generated which is a buy order and it is placed with your broker.

But how do you take your strategy live?

When you enrol in Quantra courses, you will be provided with a convenient readymade template. This template serves as a bridge between your strategy and the broker, allowing you to execute live trades based on your signals.

To get started, you simply need to click on a button provided by Quantra. This button will redirect you to a template strategy on Blueshift, which acts as the trading platform. The template is designed to be flexible and customizable, enabling you to optimise and fine-tune your strategy according to your specific requirements and preferences.

Once you're on the Blueshift template, you can make adjustments, refine parameters, and optimise your trading strategy to ensure it aligns with your goals. You have the freedom to modify the strategy based on your insights, research, and market analysis.

After you've customised the strategy to your satisfaction, you can proceed to live trade with confidence. By leveraging the Blueshift platform and the integrated Quantra template, your strategy will automatically generate orders based on the signals it receives. These orders will be sent to your broker for execution, allowing you to seamlessly execute trades in real-time.

Conclusion

Embarking on the journey of live trading can be both exciting and challenging. Our blog aims to equip you with the necessary knowledge, skills, and tools to navigate this dynamic landscape successfully. Whether you're a beginner or have some trading experience, we're here to guide you towards becoming a confident and well-informed trader.

If you wish to learn more about live trading, do explore our learning track Technical Analysis Using Quantitative Methods. The learning track consists of a series of curated courses to help you develop proficiency in technical analysis so that you experience a successful trading journey.

You can also learn Python programming and learn to identify and automate price action trading patterns. Moreover, you can learn to use up to 15+ technical indicators to generate trading signals, explain econometric models, code and backtest long-short portfolio strategy, and perform swing trading.

Disclaimer: All data and information provided in this article are for informational purposes only. QuantInsti® makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.